Variable interest rate loans lay down the foundation for this intriguing narrative, offering readers a sneak peek into a story that is loaded with details and overflowing with originality right from the start.

Get ready to dive deep into the world of variable interest rate loans and discover the ins and outs of this financial concept.

What are Variable Interest Rate Loans?

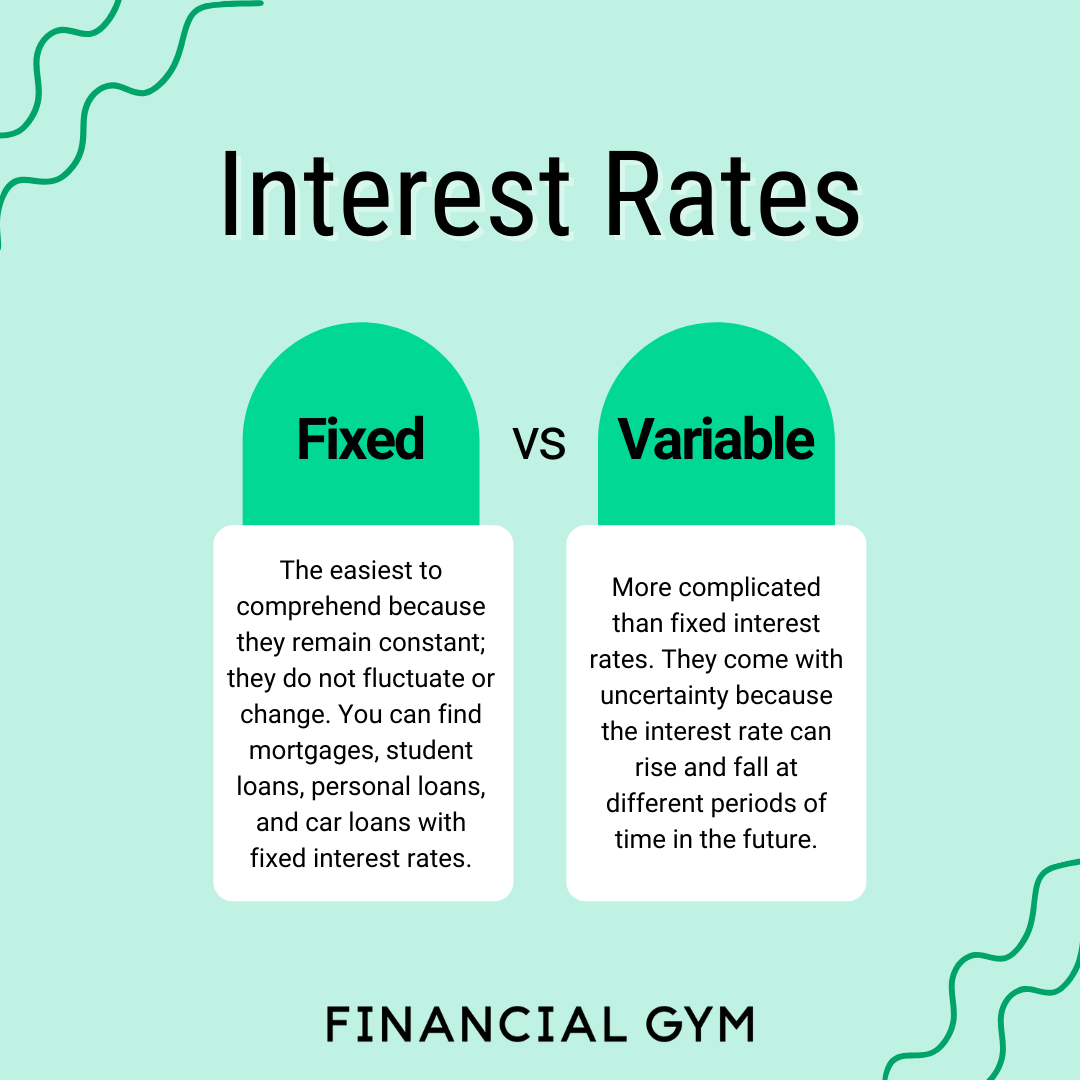

Variable interest rate loans are financial products where the interest rate can change over time based on specific factors such as market conditions or economic indicators. Unlike fixed interest rate loans where the interest rate remains the same throughout the term, variable interest rate loans offer flexibility but also come with the risk of potential rate increases.

Differences from Fixed Interest Rates

Variable interest rates differ from fixed interest rates in that they are not set in stone for the entire duration of the loan. With variable rates, borrowers may experience fluctuations in their monthly payments as interest rates change. On the other hand, fixed interest rates provide stability and predictability as borrowers know exactly how much they need to pay each month.

Financial Products Offering Variable Interest Rate Loans

- Credit Cards: Many credit cards offer variable interest rates that can change based on market conditions.

- Adjustable Rate Mortgages (ARMs): ARMs typically start with a fixed rate for a certain period and then switch to a variable rate, adjusting periodically.

- Personal Loans: Some personal loans come with variable interest rates, giving borrowers the opportunity to benefit from rate decreases or facing higher payments if rates go up.

Factors Influencing Variable Interest Rates

When it comes to variable interest rates, there are several key factors that can influence how they fluctuate over time. These factors play a significant role in determining the variability of interest rates for borrowers.

Economic Conditions Impact

Economic conditions have a major impact on variable interest rates. When the economy is strong and growing, interest rates tend to rise as demand for credit increases. On the other hand, during economic downturns or recessions, interest rates may be lowered to stimulate borrowing and spending.

- Low inflation rates can lead to lower interest rates as central banks try to encourage borrowing and investment.

- Unemployment rates can also affect interest rates, with higher unemployment potentially leading to lower rates to spur economic growth.

- Global economic factors, such as trade agreements or geopolitical events, can create uncertainty and influence interest rate movements.

Lender Adjustments Based on Market Conditions

Different lenders may adjust variable interest rates in various ways based on market conditions and their individual strategies. While some lenders may closely follow changes in the prime rate set by the Federal Reserve, others may base their adjustments on different benchmarks or internal criteria.

- Some lenders may offer introductory rates or teaser rates to attract borrowers, with the understanding that rates will adjust after a certain period.

- Market competition can also impact how lenders adjust their variable rates to remain competitive and attract borrowers.

- Lenders with a larger portfolio of variable rate loans may be more sensitive to market fluctuations and adjust rates more frequently.

Pros and Cons of Variable Interest Rate Loans

When considering variable interest rate loans, it’s essential to weigh the advantages and disadvantages to make an informed decision. Let’s explore both sides of the coin.

Advantages of Variable Interest Rate Loans

- Flexibility: Variable interest rate loans often start with lower initial rates compared to fixed-rate loans, allowing borrowers to take advantage of potential savings in the beginning.

- Potential for Decrease: If market interest rates go down, borrowers with variable rate loans can benefit from lower monthly payments and overall interest costs.

- Shorter Loan Terms: Variable rate loans sometimes offer shorter loan terms, enabling borrowers to pay off the loan faster and potentially save on interest over time.

Risks of Variable Interest Rate Loans

- Uncertainty: The main risk of variable rate loans is the uncertainty of future interest rate fluctuations, which can lead to unpredictable increases in monthly payments and overall loan costs.

- Budgeting Challenges: Fluctuating interest rates can make it challenging for borrowers to budget effectively, especially if rates increase significantly over time.

- Higher Long-Term Costs: In a rising interest rate environment, variable rate loans can end up costing more than fixed-rate loans in the long run.

Scenarios for Variable Interest Rate Loans

- Beneficial Scenario: A borrower plans to sell their home within a few years and opts for a variable rate loan with lower initial rates, aiming to save on interest costs before selling the property.

- Detrimental Scenario: A borrower chooses a variable rate loan without considering potential interest rate hikes, leading to significant payment increases that strain their monthly budget.

Managing Variable Interest Rate Loans

When it comes to managing variable interest rate loans, it’s essential to have a clear strategy in place to navigate potential fluctuations in interest rates. By planning ahead and considering your options, borrowers can effectively manage the risks associated with variable interest rates.

Budgeting and Planning for Interest Rate Fluctuations

One key strategy for managing variable interest rate loans is to budget and plan for potential fluctuations in interest rates. This involves setting aside funds to cover potential increases in monthly payments as interest rates rise. By creating a buffer in your budget, you can avoid financial strain when rates go up.

- Monitor Interest Rate Trends: Keep an eye on interest rate trends and economic indicators that could signal potential rate changes.

- Build an Emergency Fund: Save up an emergency fund to cover unexpected increases in loan payments due to rising interest rates.

- Refinance or Consolidate: Consider refinancing or consolidating your loans if interest rates are expected to rise significantly in the future.

Switching from Variable to Fixed Interest Rate Loan

If borrowers find themselves uncomfortable with the uncertainty of variable interest rates, they may have the option to switch to a fixed interest rate loan. This can provide stability in monthly payments but may come at the cost of potentially higher initial interest rates. Here are some options for borrowers looking to make the switch:

- Explore Loan Modification: Contact your lender to inquire about switching from a variable to a fixed interest rate loan through a loan modification process.

- Consider Refinancing: Another option is to refinance your loan into a fixed-rate mortgage with more predictable payments over the long term.