Hey there, ready to dive into the world of loan consolidation strategies? Buckle up as we explore the ins and outs of this financial game-changer with an American high school hip twist. Get ready to level up your money management skills!

In this guide, we’ll break down the key concepts, tips, and methods to help you navigate the world of loan consolidation like a pro. Let’s roll!

Overview of Loan Consolidation Strategies

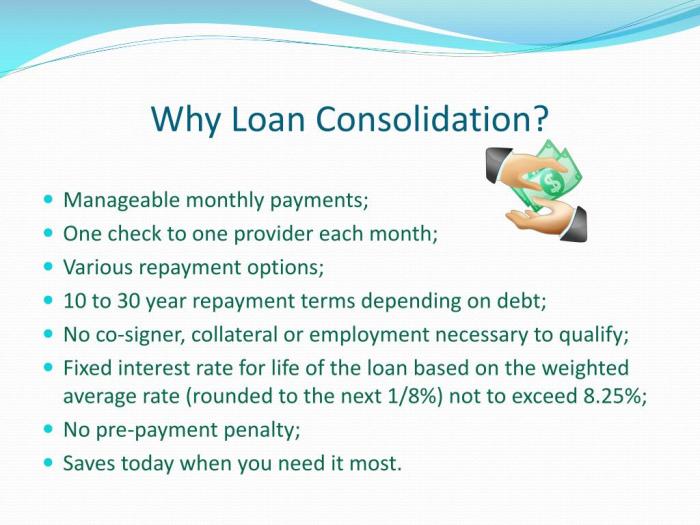

Loan consolidation is the process of combining multiple loans into a single loan with one monthly payment. This can help simplify your finances and potentially lower your interest rates.

Having a strategy for loan consolidation is important to ensure that you are making the most informed decisions about your finances. By understanding the types of loans that can be consolidated and how consolidation works, you can better manage your debt and potentially save money in the long run.

Types of Loans That Can Be Consolidated

- Student Loans: Consolidating federal student loans can help lower interest rates and simplify repayment.

- Credit Card Debt: Consolidating credit card debt into a personal loan with a lower interest rate can save you money on interest payments.

- Personal Loans: If you have multiple personal loans, consolidating them into one loan can streamline your payments and potentially reduce your overall interest costs.

Factors to Consider Before Consolidating Loans

Before diving into loan consolidation, it’s crucial to consider a few key factors that can greatly impact your financial situation. Let’s explore the impact of interest rates, credit scores, and the types of loans that can be consolidated.

Impact of Interest Rates on Loan Consolidation

When consolidating loans, the interest rate plays a significant role in determining the overall cost of the new consolidated loan. Ideally, you’ll want to consolidate loans with higher interest rates into a new loan with a lower interest rate to save money in the long run. Keep in mind that the new interest rate on the consolidated loan will be based on a weighted average of the interest rates of the loans being consolidated.

How Credit Score Affects the Ability to Consolidate Loans

Your credit score is another crucial factor that can impact your ability to consolidate loans. Lenders typically consider credit scores when offering loan consolidation options. A higher credit score can potentially qualify you for better interest rates on the consolidated loan, while a lower credit score may result in higher interest rates or even rejection of the consolidation application.

Types of Loans That Can Be Consolidated Together

Not all loans are eligible for consolidation. Generally, federal student loans are eligible for consolidation, including Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. Private student loans, credit card debt, and personal loans can also be consolidated together. However, it’s important to note that consolidating federal student loans with private loans may result in losing certain federal loan benefits.

Popular Loan Consolidation Methods

When it comes to managing your debt, there are several popular methods to consider. Whether you choose debt consolidation, refinancing, balance transfers, or student loan consolidation, each option has its own benefits and drawbacks.

Debt Consolidation vs. Refinancing

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage. On the other hand, refinancing involves taking out a new loan to pay off existing debts, often with a different term or interest rate. The key difference lies in the fact that debt consolidation keeps your debts separate, while refinancing combines them into one new loan.

Pros and Cons of Balance Transfer for Consolidation

A balance transfer involves moving high-interest debt from one or more credit cards to a new card with a lower interest rate, typically with an introductory period. This method can help you save money on interest and pay off your debt faster. However, be cautious of balance transfer fees and the risk of accumulating more debt if you continue to use your old cards.

Student Loan Consolidation and Benefits

Student loan consolidation combines multiple federal student loans into one new loan with a single monthly payment. This process can streamline your payments, extend your repayment term, and potentially lower your monthly payment amount. However, keep in mind that you may lose certain benefits, such as loan forgiveness options or income-driven repayment plans, when consolidating federal student loans.

Tips for Successful Loan Consolidation

When considering loan consolidation, it’s essential to take the necessary steps to ensure a successful outcome. Here are some tips to help you navigate the process effectively.

Create a Budget Before Consolidating Loans

Before consolidating your loans, it’s crucial to create a comprehensive budget. This will help you understand your current financial situation, including income, expenses, and debt obligations. By having a clear picture of your finances, you can determine how much you can afford to pay towards your consolidated loan each month.

Research and Compare Consolidation Options

Researching and comparing consolidation options is key to finding the best solution for your financial needs. Take the time to explore different lenders, interest rates, and repayment terms. By comparing multiple options, you can choose a consolidation plan that aligns with your goals and budget.

Importance of Understanding Terms and Conditions

Understanding the terms and conditions of loan consolidation is crucial to avoid any surprises down the road. Make sure to carefully review the interest rates, repayment schedules, fees, and any other details associated with the consolidation plan. This will help you make informed decisions and prevent any misunderstandings during the repayment process.