Ready to dive into the world of investing in healthcare stocks? Buckle up as we take you on a thrilling ride through the ins and outs of this dynamic market. Get ready to learn, strategize, and potentially profit in this exciting sector!

Understanding Healthcare Stocks

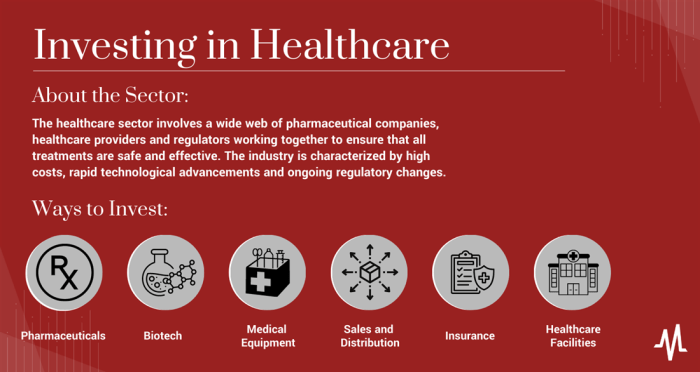

Healthcare stocks refer to shares of companies operating within the healthcare industry. These companies can include pharmaceutical companies, biotechnology firms, medical device manufacturers, healthcare providers, and health insurance companies.

Types of Companies in Healthcare Stocks

- Pharmaceutical Companies: These companies research, develop, and manufacture drugs and medications.

- Biotechnology Firms: These companies focus on using biological systems to develop products for healthcare.

- Medical Device Manufacturers: These companies produce medical equipment and devices for diagnosis and treatment.

- Healthcare Providers: These companies offer medical services such as hospitals, clinics, and telemedicine providers.

- Health Insurance Companies: These companies provide health insurance coverage to individuals and groups.

Significance of Investing in Healthcare Stocks

Investing in healthcare stocks can be beneficial for several reasons. The healthcare industry is known for its resilience, as people will always need medical care regardless of economic conditions. Additionally, advancements in technology and research often lead to innovative treatments and products, offering growth potential for healthcare companies. By investing in healthcare stocks, investors can gain exposure to a sector that plays a critical role in society while potentially benefiting from growth opportunities and diversifying their portfolio.

Factors Influencing Healthcare Stocks

Investing in healthcare stocks can be influenced by a variety of factors that impact the performance and prices of these stocks. Regulatory changes, market trends, and other key factors play a significant role in determining the success of healthcare investments.

Regulatory Changes

Regulatory changes have a direct impact on healthcare stocks as they can affect the operations, revenue, and profitability of healthcare companies. For example, changes in healthcare policies, insurance regulations, or drug approval processes can lead to fluctuations in stock prices. Investors need to closely monitor regulatory developments to make informed decisions regarding their healthcare investments.

Market Trends

Market trends also play a crucial role in influencing healthcare stock prices. Factors such as demographic shifts, technological advancements, and consumer preferences can impact the demand for healthcare products and services. For instance, an aging population may increase the demand for healthcare services, leading to potential growth opportunities for healthcare companies. Keeping an eye on market trends can help investors anticipate changes in the healthcare sector and adjust their investment strategies accordingly.

Researching Healthcare Stocks

When it comes to investing in healthcare stocks, thorough research is key to making informed decisions. Before diving in, it’s important to analyze healthcare companies and understand their financial health and competitive positioning.

Tips on Researching and Analyzing Healthcare Companies

- Look into the company’s financial reports, including revenue, expenses, and profit margins.

- Check for any recent news or developments that may impact the company’s stock price.

- Consider the company’s pipeline of products and potential for growth in the healthcare industry.

Importance of Understanding a Company’s Financial Health

Assessing a healthcare company’s financial health provides insight into its stability and growth potential. By looking at key financial metrics like debt levels, cash flow, and profitability, investors can gauge the company’s ability to weather market fluctuations and invest in future growth.

Evaluating the Competitive Positioning of Healthcare Companies

Understanding how a healthcare company stands against its competitors is crucial for predicting its future performance. Analyze factors like market share, product differentiation, and research and development capabilities to determine the company’s competitive advantage in the industry.

Risks and Rewards of Investing in Healthcare Stocks

Investing in healthcare stocks can offer both opportunities for significant rewards and potential risks that investors need to consider. Let’s delve into the details below.

Risks Associated with Investing in Healthcare Stocks

Healthcare stocks can be impacted by various risks that investors should be aware of before making investment decisions. Some of the risks include:

- Regulatory risks: The healthcare industry is heavily regulated, and changes in regulations can impact the profitability of healthcare companies.

- Clinical trial failures: Healthcare companies often rely on successful clinical trials for new drugs or treatments. Any failures in these trials can lead to significant financial losses.

- Competition: The healthcare sector is highly competitive, with new entrants constantly emerging. Increased competition can affect the market share and profitability of existing healthcare companies.

- Market volatility: Healthcare stocks can be sensitive to market fluctuations, economic conditions, and geopolitical events, leading to price volatility.

Rewards and Benefits of Investing in Healthcare Stocks

Despite the risks, investing in healthcare stocks can offer attractive rewards and benefits for investors. Some of the potential rewards include:

- Long-term growth potential: The healthcare industry is known for its long-term growth potential, driven by factors such as an aging population, technological advancements, and increasing healthcare spending.

- Diversification: Healthcare stocks can provide diversification benefits to an investor’s portfolio, as they may not move in tandem with other industries.

- Innovation and breakthroughs: Healthcare companies are constantly innovating and developing new treatments, drugs, and technologies that can lead to significant breakthroughs and financial gains.

Comparing Volatility of Healthcare Stocks with Other Industries

When compared to other industries, healthcare stocks are often considered to be less volatile due to the essential nature of healthcare services and products. However, healthcare stocks can still experience volatility, especially in response to regulatory changes, clinical trial outcomes, or market conditions. It’s essential for investors to carefully assess their risk tolerance and investment goals before investing in healthcare stocks.

Strategies for Investing in Healthcare Stocks

Investing in healthcare stocks requires a strategic approach to maximize returns and manage risks effectively. Here are some key strategies to consider:

Diversification within the Healthcare Sector

Diversification is crucial when investing in healthcare stocks to spread out risk and capture opportunities across different subsectors. By investing in a variety of healthcare companies, such as pharmaceuticals, biotechnology, medical devices, and healthcare services, you can reduce the impact of any negative developments in a single area.

- Allocate your investments across different subsectors within healthcare to minimize risk.

- Consider investing in both established companies and emerging healthcare startups to balance risk and potential returns.

- Monitor your portfolio regularly and make adjustments as needed to maintain diversification.

Remember, diversification is key to building a resilient healthcare stock portfolio.

Creating a Balanced Healthcare Stock Portfolio

Building a balanced healthcare stock portfolio involves careful selection of investments based on your risk tolerance, investment goals, and market trends. Here’s how you can create a well-rounded healthcare stock portfolio:

- Research and analyze healthcare companies to identify strong performers with growth potential.

- Consider investing in both large-cap and small-cap healthcare stocks to diversify your portfolio.

- Evaluate the financial health and competitive positioning of each company before making investment decisions.

- Monitor industry trends, regulatory changes, and healthcare innovations that could impact your investments.

By creating a balanced healthcare stock portfolio, you can position yourself for long-term growth and stability in the healthcare sector.

Emerging Trends in Healthcare Stocks

As the healthcare industry continues to evolve, several trends are shaping the landscape of healthcare stocks. These trends are crucial for investors to consider when making decisions in the market.

Technological Advancements in Healthcare

Technological innovations have a significant impact on healthcare stock performance. Companies investing in cutting-edge technologies such as telemedicine, artificial intelligence, and wearable health devices are experiencing growth in the market.

Personalized Medicine

Personalized medicine, also known as precision medicine, is gaining traction in the healthcare industry. This approach tailors medical treatment to individual patients based on their genetic makeup, lifestyle, and environmental factors. Investing in companies at the forefront of personalized medicine could yield promising returns.

Healthcare Data Analytics

The use of data analytics in healthcare is revolutionizing the way medical professionals make decisions and deliver care. Companies specializing in healthcare data analytics are becoming increasingly valuable in the stock market as they provide insights to improve patient outcomes and streamline operations.