Kicking off with Index funds explained, this opening paragraph is designed to captivate and engage the readers, providing an in-depth look at what index funds are and how they can benefit investors. From breaking down the basics to exploring key features and performance, this guide will unravel the complexities of index funds in a way that’s easy to understand and apply.

Index funds have been gaining popularity in the investment world for their simplicity and potential returns. Whether you’re a novice investor or a seasoned pro, understanding index funds is essential to building a diversified portfolio and achieving financial goals.

Introduction to Index Funds

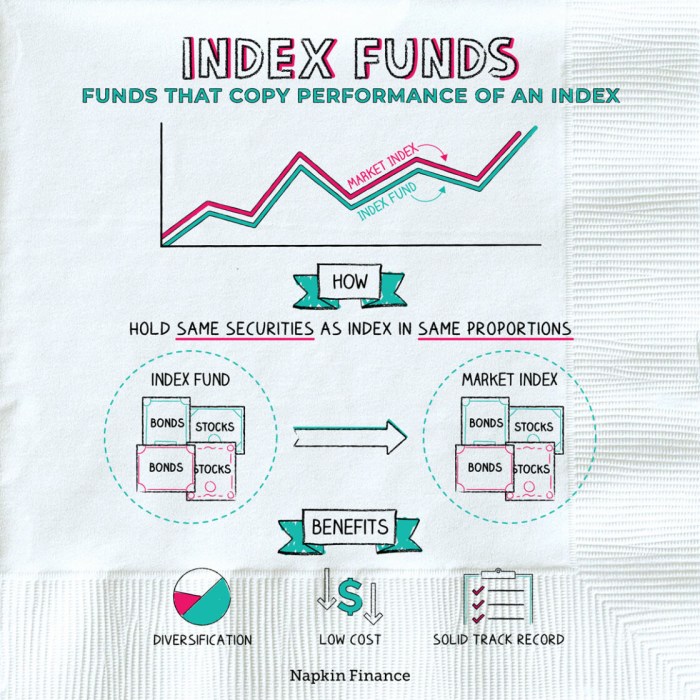

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific market index, such as the S&P 500. Instead of trying to beat the market, index funds seek to replicate the returns of the index they are tracking.

Index funds work by investing in the same securities that are included in the chosen index in the same proportions. This passive investing approach eliminates the need for active management and stock picking, resulting in lower fees and reduced risk.

Benefits of Investing in Index Funds

- Diversification: Index funds provide instant diversification by investing in a large number of securities within the index, reducing individual stock risk.

- Low Costs: Due to their passive management style, index funds typically have lower expense ratios compared to actively managed funds.

- Consistent Returns: By tracking a market index, index funds offer consistent returns that mimic the overall market performance.

- Simplicity: Investing in index funds is straightforward and requires minimal effort, making it ideal for beginners or those looking for a hands-off approach.

Key Features of Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index. These funds are known for their passive management style and low expense ratios, making them popular among investors looking for a cost-effective way to diversify their portfolios.

Main Characteristics of Index Funds

- Passive Management: Index funds track a specific market index and aim to replicate its performance, rather than trying to outperform the market.

- Low Expense Ratios: Index funds have lower fees compared to actively managed funds since they require minimal management and research.

- Diversification: By investing in an index fund, investors gain exposure to a wide range of securities within the index, reducing the risk of individual stock selection.

- Transparency: The holdings of an index fund are publicly disclosed, allowing investors to know exactly what they are investing in at any given time.

Comparison with Actively Managed Funds

Unlike index funds, actively managed funds are actively managed by fund managers who aim to beat the market through research and stock selection. Here are some key differences:

- Performance: Actively managed funds aim to outperform the market, while index funds aim to match the performance of a specific index.

- Expense Ratios: Actively managed funds tend to have higher expense ratios due to the active management involved, making them costlier for investors.

- Turnover: Actively managed funds typically have higher turnover rates as fund managers buy and sell securities more frequently, leading to potential tax implications for investors.

Examples of Popular Index Funds

Some popular index funds available in the market include:

- S&P 500 Index Fund: This fund tracks the performance of the 500 largest publicly traded companies in the United States.

- Total Stock Market Index Fund: This fund provides exposure to the entire U.S. stock market, including small, mid, and large-cap stocks.

- NASDAQ-100 Index Fund: This fund focuses on the top 100 non-financial companies listed on the NASDAQ stock exchange.

Understanding Index Fund Composition

Index funds are composed of a collection of securities that mimic a specific market index. These funds are passively managed, meaning they aim to replicate the performance of the index they track rather than actively selecting individual stocks or securities.

Importance of Diversification in Index Funds

Diversification is crucial in index funds as it helps spread risk across a wide range of assets. By holding a diverse portfolio of securities, index funds reduce the impact of any single stock’s performance on the overall fund.

- Ensures that losses in one sector or industry are offset by gains in other areas

- Reduces the overall volatility of the fund

- Provides exposure to a broader range of companies and sectors

Typical Holdings within Index Funds

Index funds typically hold a mix of stocks or bonds that mirror the composition of the underlying index they track. The exact holdings can vary depending on the specific index being replicated.

For example, an S&P 500 index fund would hold the 500 largest publicly traded companies in the United States.

Performance and Risks of Index Funds

Index funds have historically shown strong performance compared to actively managed funds, primarily due to their lower fees and passive management style. Over the long term, index funds have often outperformed the majority of actively managed funds, making them a popular choice for many investors seeking steady returns. However, it is essential to understand both the performance and risks associated with investing in index funds.

Historical Performance of Index Funds

Index funds have consistently delivered competitive returns over the years, mirroring the performance of the underlying index they track. For example, the S&P 500 index fund has historically provided an average annual return of around 7% to 10%, depending on the time period analyzed. Investors can use historical performance data to assess the potential returns of an index fund and make informed investment decisions.

Risks Associated with Investing in Index Funds

While index funds offer diversification and low costs, they are not entirely risk-free. One of the primary risks is market risk, as index funds are directly impacted by market fluctuations. In times of economic downturns or bear markets, index funds can experience significant losses along with the broader market. Additionally, tracking error risk and liquidity risk are other factors that investors should consider when investing in index funds.

Impact of Market Conditions on Index Fund Returns

Market conditions play a crucial role in determining the returns of index funds. Bull markets tend to benefit index funds, as they track the overall market performance and capitalize on upward trends. Conversely, during bear markets or periods of high volatility, index funds may struggle to generate positive returns. It is essential for investors to be aware of how market conditions can impact the performance of index funds and adjust their investment strategies accordingly.