When it comes to tackling credit card debt, it’s essential to have a solid plan in place. In this guide, we’ll dive into the nitty-gritty of paying off credit card debt, exploring different strategies, tips, and expert advice to help you become debt-free. So, buckle up and get ready to take control of your finances like a boss!

Now, let’s break down the key components of paying off credit card debt to set you on the path to financial freedom.

Understanding Credit Card Debt

Credit card debt refers to the amount of money you owe to a credit card company for purchases made using the card. This debt typically incurs high-interest rates, making it challenging to pay off quickly. The implications of carrying credit card debt include damaging your credit score, incurring additional fees, and potentially falling into a cycle of debt.

Impact of Interest Rates

Interest rates play a significant role in credit card debt repayment. The higher the interest rate on your credit card, the more you will end up paying in the long run. For example, if you only make minimum payments on a high-interest credit card, you could end up paying significantly more than the original purchase amount due to accrued interest.

Consequences of High Credit Card Balances

Carrying a high balance on your credit card can have serious consequences. Not only does it increase the amount of interest you owe, but it also negatively impacts your credit score. A high credit card balance relative to your credit limit can signal to lenders that you are financially overextended, making it harder to qualify for loans or other credit in the future.

Creating a Repayment Plan

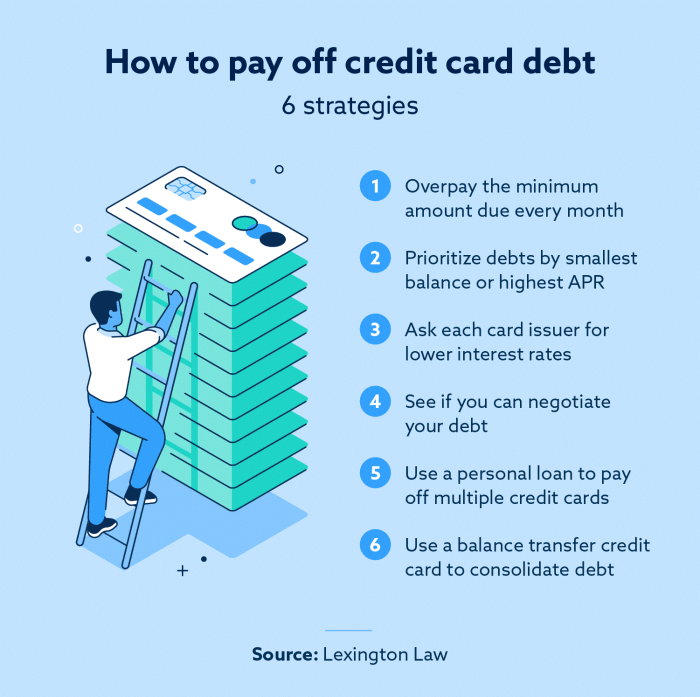

Paying off credit card debt requires a solid repayment plan to help you stay on track and achieve your financial goals. Let’s explore different strategies and tips to help you effectively manage and reduce your debt.

Snowball Method

The snowball method involves paying off your smallest debt first while making minimum payments on larger debts. Once the smallest debt is paid off, you move on to the next smallest debt, creating a snowball effect that builds momentum as you pay off each debt.

Avalanche Method

The avalanche method focuses on paying off debts with the highest interest rates first. By tackling high-interest debts first, you can save money on interest payments over time and pay off your debt more efficiently.

Setting a Budget

Creating a budget is essential for allocating funds towards debt repayment. By tracking your expenses and income, you can identify areas where you can cut back and redirect those funds towards paying off your credit card debt.

Negotiating Lower Interest Rates

Contacting your credit card companies to negotiate lower interest rates can help you save money on interest payments and pay off your debt faster. Be prepared to explain your situation and demonstrate your commitment to repaying your debt to increase your chances of successfully negotiating lower rates.

Increasing Income and Cutting Expenses

In order to pay off credit card debt faster, it is important to not only create a repayment plan but also find ways to increase your income and cut down on expenses.

Increasing Income

One way to boost your income is to look for opportunities for side hustles or part-time jobs. This could include freelance work, tutoring, pet sitting, or driving for ride-sharing services like Uber or Lyft. By earning extra money on the side, you can allocate more funds towards paying off your credit card debt.

Cutting Expenses

- Consider cutting down on dining out and cooking more meals at home. Eating out can be a major expense that can quickly add up.

- Avoid unnecessary subscriptions or memberships that you do not regularly use. Canceling these can save you money each month.

- Shop at thrift stores or online marketplaces for clothing and other items instead of buying brand new. You can find great deals and save money.

- Reduce energy costs by turning off lights when not in use, unplugging electronics, and setting your thermostat at an energy-efficient temperature.

By making these adjustments and being mindful of your spending habits, you can free up more money to put towards paying off your credit card debt.

Seeking Professional Help

When you’re feeling overwhelmed by credit card debt and struggling to make progress on your own, it might be time to consider seeking help from a credit counselor or financial advisor. These professionals can provide expert guidance and support to help you navigate your way out of debt and towards financial stability.

Debt Consolidation

Debt consolidation is an option to simplify credit card payments by combining multiple debts into a single loan or payment plan. This can help lower your interest rates, reduce monthly payments, and make it easier to manage your debt. However, it’s important to carefully consider the terms of the consolidation and ensure it’s the right choice for your financial situation.

Bankruptcy as a Viable Solution

Bankruptcy may be a viable solution for overwhelming credit card debt when all other options have been exhausted. It’s a legal process that can help you eliminate or repay your debts under the protection of the bankruptcy court. While bankruptcy can provide relief from debt, it also has long-lasting consequences on your credit score and financial future. It’s crucial to consult with a bankruptcy attorney to fully understand the implications and determine if it’s the best course of action for your situation.