With How to leverage debt at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

When it comes to navigating the world of business finance, leveraging debt can be a powerful tool to fuel growth and expansion. By strategically utilizing borrowed funds, companies can seize opportunities, boost operations, and reach new heights. Let’s dive into the exciting realm of leveraging debt and discover the keys to financial success.

Importance of leveraging debt

When used wisely, leveraging debt can provide businesses with the necessary capital to expand, invest in new opportunities, and grow their operations.

Benefits of leveraging debt

- Increased liquidity: By taking on debt, companies can access additional funds to cover expenses or invest in projects that can lead to increased profitability.

- Accelerated growth: Debt can be used to finance expansion plans, launch new products, or enter new markets, allowing businesses to grow at a faster pace.

- Tax advantages: Interest payments on debt are typically tax-deductible, reducing the overall tax burden on the company and increasing cash flow.

Risks of leveraging debt and mitigation strategies

- Interest rate risk: Fluctuations in interest rates can impact the cost of debt repayment. To mitigate this risk, companies can consider fixed-rate loans or use interest rate hedging strategies.

- Debt overload: Taking on too much debt can strain a company’s finances and lead to insolvency. It is essential to carefully assess the company’s ability to repay debt and maintain a healthy debt-to-equity ratio.

- Market risks: Economic downturns or industry-specific challenges can affect a company’s ability to generate revenue and repay debt. Companies can diversify their revenue streams or establish contingency plans to mitigate these risks.

Types of debt to leverage

When it comes to leveraging debt, there are various types of debt that businesses can utilize to finance their operations and growth. Each type of debt comes with its own set of advantages and disadvantages, so it’s important for businesses to carefully consider their options before making a decision.

Bank loans

Bank loans are a common form of debt used by businesses to finance their activities. These loans are typically obtained from traditional banks and can come in the form of term loans, lines of credit, or revolving credit facilities.

- Advantages:

- Lower interest rates compared to other forms of debt

- Structured repayment schedule

- Disadvantages:

- Strict eligibility criteria

- Collateral may be required

Bonds

Bonds are debt securities issued by companies to investors in exchange for capital. Businesses can leverage bonds to raise funds for large projects or expansions.

- Advantages:

- Fixed interest rates

- Can attract a wider range of investors

- Disadvantages:

- Higher interest rates compared to bank loans

- May require payment of periodic interest

Lines of credit

Lines of credit are flexible forms of debt that allow businesses to borrow funds up to a predetermined limit. Businesses can draw on this credit line as needed and only pay interest on the amount borrowed.

- Advantages:

- Flexibility in borrowing funds

- Interest only paid on amount used

- Disadvantages:

- Higher interest rates than traditional loans

- Variable interest rates

Strategies for leveraging debt effectively

Debt can be a powerful tool for businesses when used strategically. Here are some key strategies to leverage debt effectively:

Steps to determine the right amount of debt to leverage for a business

- Assess your current financial situation: Understand your cash flow, assets, and liabilities to determine how much debt your business can comfortably take on.

- Set clear financial goals: Define what you aim to achieve with the debt and how it will contribute to the growth and success of your business.

- Consider the cost of debt: Evaluate the interest rates, fees, and repayment terms of potential loans to ensure they align with your financial capabilities.

- Consult with financial experts: Seek advice from accountants or financial advisors to help you make informed decisions about leveraging debt.

Discuss how to negotiate favorable terms when taking on debt

- Shop around for the best deals: Compare offers from different lenders to find the most favorable terms and interest rates for your business.

- Highlight your business strengths: Emphasize your track record, revenue growth, and future potential to negotiate better terms with lenders.

- Be prepared to negotiate: Don’t be afraid to negotiate on interest rates, repayment schedules, or collateral requirements to secure more favorable terms.

- Review the fine print: Carefully read and understand all loan agreements to ensure there are no hidden fees or unfavorable clauses that could impact your business in the long run.

Provide tips on managing debt effectively to maximize its benefits

- Create a repayment plan: Develop a clear strategy for repaying your debt on time to avoid costly penalties and maintain a positive credit history.

- Monitor your cash flow: Keep a close eye on your cash flow to ensure you have enough funds to cover debt repayments and other operational expenses.

- Stay disciplined: Avoid taking on more debt than your business can handle and resist the temptation to use debt for non-essential expenses.

- Seek professional help if needed: If you’re struggling to manage your debt, consider working with a financial advisor or credit counselor to develop a plan for getting back on track.

Impact of leveraging debt on financial health

When it comes to the financial health of a company, leveraging debt can have a significant impact on various aspects such as the balance sheet and financial ratios. Understanding how debt-to-equity ratio plays a crucial role in leveraging debt responsibly is essential for long-term financial stability.

Analyze how leveraging debt can affect a company’s balance sheet and financial ratios

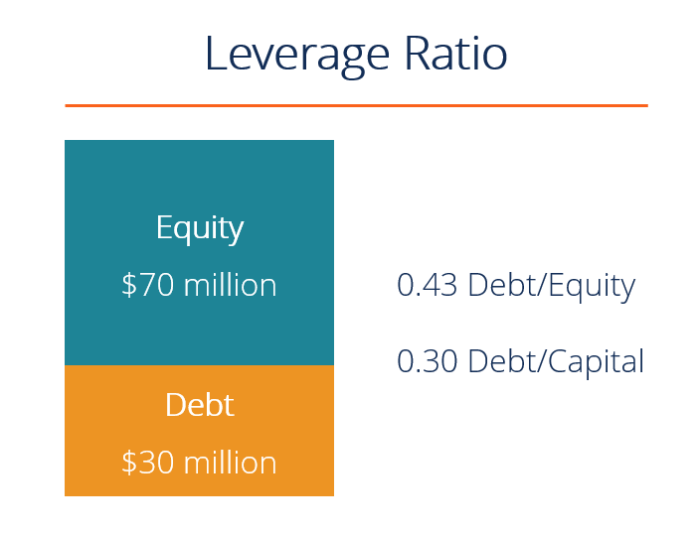

When a company decides to leverage debt, it increases its liabilities, which can impact the balance sheet by adding more debt and potentially affecting liquidity ratios. This can also influence financial ratios such as debt-to-equity ratio, interest coverage ratio, and return on equity.

Explain the concept of debt-to-equity ratio and its significance in leveraging debt

The debt-to-equity ratio is a financial metric that indicates the proportion of debt a company is using to finance its operations compared to equity. A high debt-to-equity ratio suggests that a company is relying more on debt, which can increase financial risk. On the other hand, a low ratio indicates that the company is more reliant on equity, which can be seen as a safer option.

Debt-to-Equity Ratio = Total Debt / Total Equity

Discuss how leveraging debt responsibly can improve a company’s financial health in the long term

By leveraging debt responsibly, a company can use borrowed funds to invest in growth opportunities, expand operations, or improve efficiency. This can lead to increased profitability, higher returns for shareholders, and ultimately strengthen the company’s financial position in the long run.