Diving into the world of credit report errors is like stepping into a mystery novel filled with twists and turns. From uncovering the different types of errors to navigating the steps of disputing them, this guide will equip you with the knowledge needed to set the record straight and reclaim your financial reputation.

Get ready to unravel the complexities of credit reports and arm yourself with the tools to tackle inaccuracies head-on.

Understanding Credit Report Errors

When it comes to credit report errors, it’s essential to know the common types, their impact, and why checking your report regularly is crucial.

Common Types of Credit Report Errors

- Incorrect personal information such as name, address, or social security number.

- Accounts that don’t belong to you or have been closed but still appear as open.

- Inaccurate payment history, like late payments that were actually made on time.

- Identity theft, where someone else’s accounts are showing up on your report.

Impact of Credit Report Errors

- Lower credit score, affecting your ability to get loans or credit cards.

- Higher interest rates on loans due to the perceived risk.

- Difficulty in obtaining approval for a mortgage or rental application.

- Potential denial of job opportunities as some employers check credit reports.

Importance of Regularly Checking Credit Reports

Regularly checking your credit report allows you to catch errors early and take action to correct them. It also helps in monitoring for any signs of identity theft or fraudulent activity. By staying on top of your credit report, you can ensure your financial health and future opportunities are protected.

Identifying Credit Report Errors

When it comes to identifying credit report errors, it’s crucial to know how to obtain your free credit report, review it thoroughly, and spot any inaccuracies that may be affecting your credit score.

To start the process, you can request a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year at AnnualCreditReport.com. Make sure to take advantage of this opportunity to access your credit information without any cost.

Reviewing Your Credit Report

- Check for any personal information errors, such as misspelled names or incorrect addresses.

- Review all listed accounts to ensure they belong to you and that the payment history is accurate.

- Look out for any unfamiliar accounts or inquiries that could indicate identity theft.

Identifying Inaccuracies

- Pay attention to any accounts that show late payments when you know you paid on time.

- Verify the credit limits and balances on each account to make sure they are reported correctly.

- Look for any accounts that are duplicated or incorrectly labeled as closed when they are still active.

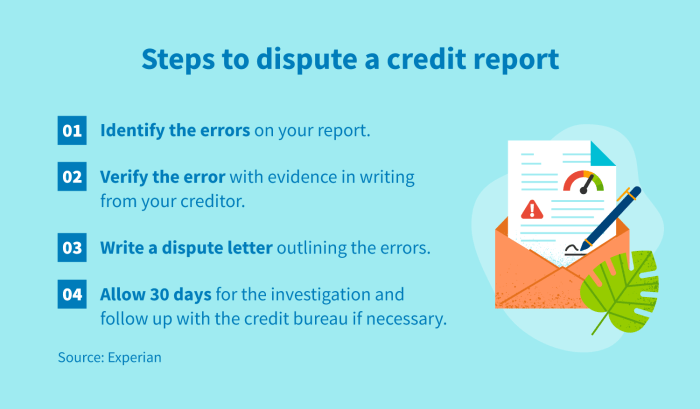

Steps to Dispute Credit Report Errors

When disputing credit report errors, there are specific steps you need to follow to ensure a successful resolution. It is crucial to document all communications related to disputing errors to track progress and provide evidence if needed. Providing supporting documents can also strengthen your case and help in disputing errors effectively.

1. Obtain a Copy of Your Credit Report

- Request a free copy of your credit report from the three major credit bureaus – Equifax, Experian, and TransUnion.

- Review the report carefully to identify any errors or inaccuracies.

2. Write a Dispute Letter

- Compose a formal dispute letter addressing the specific errors you have identified.

- Include any supporting documents such as receipts, statements, or correspondence that can help validate your claim.

3. Submit Your Dispute

- Send your dispute letter along with the supporting documents to the credit bureau(s) reporting the errors.

- Ensure you send the documents via certified mail to have proof of delivery.

4. Follow Up

- Monitor the progress of your dispute and follow up with the credit bureau(s) if necessary.

- Keep a record of all communications, including dates and names of representatives you have spoken to.

Contacting Credit Bureaus and Creditors

When it comes to disputing credit report errors, reaching out to credit bureaus and creditors is crucial in rectifying any inaccuracies that may be affecting your credit score.

Contacting Credit Bureaus

- Start by obtaining a copy of your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion.

- Look for the contact information provided on the credit report to reach out to each bureau individually.

- Submit a formal dispute letter either online, through mail, or via phone, clearly outlining the errors you have identified.

- Keep a record of all communication with the credit bureaus, including confirmation numbers, to track the progress of your dispute.

Contacting Creditors

- Once you have identified errors on your credit report, contact the creditors associated with the inaccurate information.

- Reach out to the creditors directly through the contact information provided on your credit report or on your billing statements.

- Explain the errors you have found and provide any supporting documentation to strengthen your case for disputing the inaccuracies.

- Follow up with the creditors regularly to ensure that they are taking the necessary steps to correct the errors on your credit report.

Effective communication is key when disputing credit report errors. Be clear, concise, and persistent in your efforts to rectify any inaccuracies that may be negatively impacting your credit score.

Following Up on Disputes

After submitting a dispute for credit report errors, it’s important to understand the timeline for credit bureaus to investigate the issue. Typically, credit bureaus have 30 days to investigate and respond to your dispute. During this time, they will contact the creditor in question and gather relevant information to make a decision.

Timeline for Credit Bureau Investigation

- Within 5 business days: Credit bureaus must inform the creditor about the dispute.

- Within 30 days: Credit bureaus must complete the investigation and provide you with the results.

Following Up on Dispute Progress

- Regularly check your mail and email for updates from the credit bureaus regarding the dispute.

- Consider setting reminders to follow up if you haven’t heard back within the 30-day timeline.

- Contact the credit bureaus directly to inquire about the status of your dispute if needed.

What to Do If Errors Are Not Resolved

- If the errors on your credit report are not resolved after disputing, you can escalate the issue by filing a complaint with the Consumer Financial Protection Bureau (CFPB).

- You may also consider seeking legal assistance to help resolve the credit report errors if necessary.

- Continue monitoring your credit report regularly to ensure that any unresolved errors do not negatively impact your credit score.