Diving deep into the world of calculating ROI, this guide will take you on a journey filled with insights and practical tips. Get ready to uncover the secrets behind making informed business decisions based on return on investment.

Whether you’re a seasoned entrepreneur or just starting out in the business world, understanding how to calculate ROI is essential for success. Let’s explore the key aspects of ROI calculation together.

Importance of ROI Calculation

Calculating ROI is essential for businesses to measure the profitability of their investments and make informed decisions.

Impact on Decision-Making

ROI plays a crucial role in guiding decision-making processes within a company. By analyzing the return on investment, businesses can determine the effectiveness of various projects or strategies and allocate resources wisely.

Evaluation of Investment Success

ROI is also significant in evaluating the success of investments. It helps businesses assess whether the money put into a particular venture or campaign is generating adequate returns or if adjustments need to be made to improve profitability.

Formula for Calculating ROI

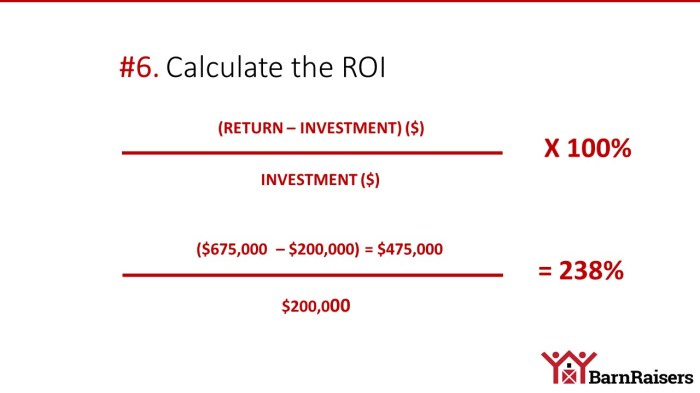

When it comes to calculating ROI (Return on Investment), the formula is pretty straightforward. You take the net profit of an investment and divide it by the initial cost of the investment. The result is then expressed as a percentage.

Components of the ROI Formula

- The net profit is the amount of money gained or lost from the investment.

- The initial cost refers to the total amount of money invested initially.

ROI = (Net Profit / Initial Cost) x 100

Examples of Applying the ROI Formula

Let’s look at a couple of scenarios to see how the ROI formula works:

-

You invest $10,000 in a project and at the end of the year, your net profit is $2,000.

ROI = ($2,000 / $10,000) x 100 = 20%

This means your ROI for this investment is 20%.

-

Another example is if you spend $5,000 on marketing and it generates $15,000 in revenue.

ROI = ($15,000 – $5,000) / $5,000 x 100 = 200%

In this case, your ROI would be 200%.

Factors Affecting ROI Calculation

When calculating ROI, there are several key factors that can greatly influence the outcome. These factors play a crucial role in determining the profitability and success of an investment. Let’s dive into some of the main factors that affect ROI calculations.

Costs and Returns

- The costs associated with an investment directly impact the ROI. These costs can include initial investment, operating expenses, maintenance costs, and any other expenses incurred.

- Returns, on the other hand, refer to the revenue generated from the investment. This can include profits, sales, or any other financial gains.

- The relationship between costs and returns is essential in determining the overall ROI. A high return with low costs will result in a higher ROI, while high costs with low returns will lead to a lower ROI.

External Factors

- External factors such as market conditions, economic trends, and regulatory changes can have a significant impact on ROI calculations.

- Changes in consumer behavior, competitive landscape, or technological advancements can influence the success of an investment and ultimately affect the ROI.

- It’s important to consider these external factors when calculating ROI to ensure a more accurate representation of the investment’s performance.

Interpreting ROI Results

Understanding how to interpret ROI results is crucial for making informed business decisions. It allows you to assess the effectiveness of your investments and determine the overall success of your strategies.

Analyzing ROI Figures

When analyzing ROI figures, it’s important to consider the following strategies:

- Compare ROI values over different time periods to track performance trends.

- Evaluate ROI in relation to industry benchmarks to gauge competitiveness.

- Break down ROI components to identify areas for improvement or optimization.

Implications of ROI Values

The different ROI values can have significant implications on business decisions:

| ROI Value | Implications |

|---|---|

|

Indicates a profitable investment with returns exceeding the initial cost. |

|

Shows that the investment has broken even, generating returns equal to the cost. |

|

Suggests a loss-making investment where returns are less than the initial cost. |