When it comes to navigating the world of Health savings accounts (HSAs), it’s like stepping into a treasure trove of financial wellness. Let’s delve into the ins and outs of HSAs and discover how they can revolutionize your approach to healthcare expenses.

As we peel back the layers of this financial tool, you’ll uncover a wealth of information that can empower you to take control of your medical expenses like a boss.

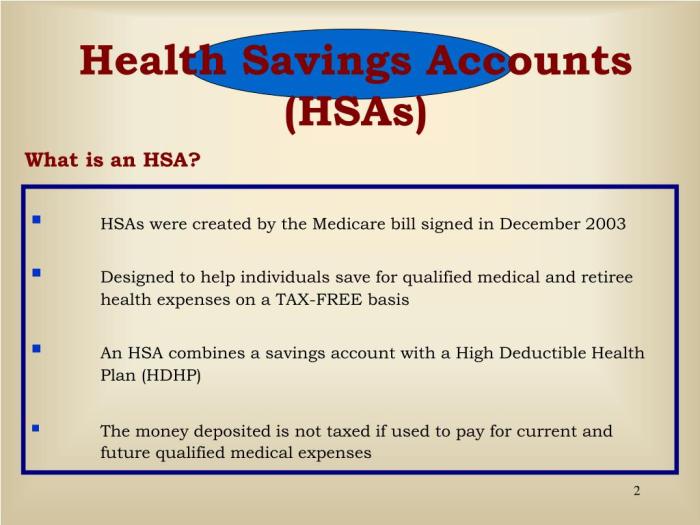

Overview of Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are special accounts that allow individuals to save money specifically for medical expenses. The main purpose of an HSA is to help people cover healthcare costs not covered by their insurance plans, such as deductibles, copayments, and other out-of-pocket expenses.

Eligibility Criteria for Opening an HSA

To be eligible to open an HSA, you must be covered by a high-deductible health plan (HDHP). Additionally, you cannot be enrolled in Medicare or be claimed as a dependent on someone else’s tax return. Other eligibility requirements may apply, so it’s important to verify your eligibility before opening an HSA.

Benefits of Having an HSA

- Tax advantages: Contributions to an HSA are tax-deductible, and any interest or investment earnings grow tax-free. Additionally, withdrawals for qualified medical expenses are also tax-free.

- Flexibility: Funds in an HSA can be rolled over year after year, allowing you to save for future medical expenses or use the funds for retirement healthcare costs.

- Control: With an HSA, you have control over how you use your healthcare dollars. You can choose how to spend the money in your account on qualified medical expenses that best suit your needs.

- Portability: HSAs are tied to the individual, not the employer, meaning you can keep your HSA even if you change jobs or retire.

How Health Savings Accounts Work

Health Savings Accounts (HSAs) are a great way to save for medical expenses while also enjoying tax advantages. Here’s how they work:

Opening an HSA

To open an HSA, you must be covered by a high deductible health plan (HDHP). You can usually open an HSA through your employer or a financial institution. Once open, you can start making contributions to your HSA.

Contributions to an HSA

Contributions to an HSA can be made by you, your employer, or both. The total contribution limit is set annually by the IRS. For 2021, the limit for individuals is $3,600 and $7,200 for families. If you are 55 or older, you can make an additional catch-up contribution of $1,000.

Tax Advantages of HSAs

One of the main benefits of an HSA is the tax advantages it offers. Contributions made to an HSA are tax-deductible, reducing your taxable income. The money in your HSA grows tax-free, and when used for qualified medical expenses, withdrawals are also tax-free. This triple tax advantage makes HSAs a powerful tool for saving for healthcare costs.

Using Funds from Health Savings Accounts

When it comes to using funds from your Health Savings Account (HSA), it’s important to understand what expenses are eligible, how to access the funds, and any limitations or restrictions that may apply.

Eligible Medical Expenses

Here are some examples of eligible medical expenses that you can pay for using HSA funds:

- Prescription medications

- Doctor’s visits

- Dental care

- Vision care (eyeglasses, contact lenses)

- Medical equipment (crutches, wheelchairs)

Accessing Funds from an HSA

To access funds from your HSA, you can typically use a debit card linked to the account or reimburse yourself for out-of-pocket expenses. Some HSA providers may also offer online portals or mobile apps for easy access to your funds.

Limitations and Restrictions

While HSAs offer great flexibility in using funds for medical expenses, there are some limitations and restrictions to be aware of:

- Withdrawals for non-eligible expenses may incur penalties and taxes.

- There are annual contribution limits set by the IRS.

- Unused funds may roll over year to year, but there are limits on how much can be carried over.

Managing Health Savings Accounts

Managing your Health Savings Account (HSA) effectively is crucial to maximizing its benefits and ensuring you have funds available for medical expenses when needed.

Tips for Effective HSA Management

- Regularly review your HSA balance and contributions to track your savings progress.

- Keep all receipts and documentation for qualified medical expenses to ensure proper record-keeping.

- Consider automating contributions to your HSA to ensure consistent savings.

- Explore investment options within your HSA to potentially grow your funds over time.

- Stay informed about any changes in HSA regulations or contribution limits to make adjustments accordingly.

Employer’s Role in Offering HSAs

Employers play a significant role in offering HSAs to employees as part of their benefits package, providing a valuable tool for managing healthcare costs.

Employers may contribute to employees’ HSAs, match contributions, or provide educational resources on how to use the account effectively.

Tracking and Reporting HSA Contributions and Withdrawals

It’s essential to accurately track and report contributions and withdrawals from your HSA to ensure compliance with IRS regulations and avoid penalties.

- Keep detailed records of all contributions made to your HSA, including both your own and any employer contributions.

- Report HSA contributions on your tax return using Form 8889 to claim any tax benefits associated with the account.

- Document all withdrawals from your HSA and ensure they are used for qualified medical expenses to avoid tax consequences.

- Review your HSA statements regularly to verify transactions and identify any discrepancies.

Investing Health Savings Account Funds

Investing your Health Savings Account (HSA) funds can provide you with the opportunity to grow your money over time, potentially increasing your healthcare savings for the future. By choosing to invest your HSA funds wisely, you can take advantage of the benefits offered by different investment options.

Investment Options Available for HSA Funds

When it comes to investing your HSA funds, you typically have a range of options to choose from, including mutual funds, stocks, bonds, and other investment vehicles. These options allow you to diversify your investment portfolio and potentially earn higher returns compared to leaving your funds in a regular savings account.

- Mutual Funds: These are a popular choice for HSA investments, offering a diversified portfolio managed by professionals.

- Stocks: Investing in individual stocks can provide higher potential returns but also comes with higher risk.

- Bonds: Bonds offer a more conservative investment option with fixed interest payments.

Tip: Consider your risk tolerance, investment goals, and timeline when choosing investment options for your HSA funds.

Benefits of Investing HSA Funds

Investing your HSA funds can potentially help your money grow at a faster rate compared to a regular savings account. By earning returns on your investments, you can maximize the growth of your healthcare savings and better prepare for future medical expenses.

- Higher Returns: Investments have the potential to generate higher returns compared to the interest earned in a savings account.

- Diversification: Investing in different assets can help spread risk and potentially increase overall returns.

- Inflation Protection: Investing can help your money keep pace with inflation and maintain its purchasing power over time.

Tip: Regularly review your investment choices and adjust your portfolio based on changes in your financial situation or investment goals.

Tips for Making Informed Investment Decisions with HSA Funds

When deciding how to invest your HSA funds, it’s essential to consider your investment goals, risk tolerance, and time horizon. Here are some tips to help you make informed investment decisions:

- Do Your Research: Understand the different investment options available and their associated risks and potential returns.

- Seek Professional Advice: Consider consulting with a financial advisor to help you develop an investment strategy that aligns with your goals.

- Monitor Your Investments: Regularly review your investment portfolio and make adjustments as needed to stay on track with your financial objectives.