Diving into global investment trends is like exploring the coolest trends in the financial world. From stocks to real estate, this intro sets the stage for an epic journey through the world of investments.

Get ready to uncover the secrets behind successful investing and discover how different regions and technologies are shaping the landscape of global investments.

Overview of Global Investment Trends

Global investment trends refer to the patterns and movements in investments across different countries and industries on a global scale. These trends are influenced by various factors and play a crucial role in shaping the financial landscape.

Key factors driving global investment trends include economic conditions, geopolitical events, technological advancements, and market sentiment. Economic conditions such as interest rates, inflation, and GDP growth can impact investment decisions. Geopolitical events like trade wars or political instability can create uncertainty in the markets. Technological advancements, such as the rise of artificial intelligence or blockchain, can create new investment opportunities. Market sentiment, influenced by factors like investor confidence and risk appetite, can also drive investment trends.

Understanding global investment trends is essential for investors as it helps them make informed decisions about where to allocate their capital. By staying informed about the latest trends, investors can identify potential opportunities for growth and diversification. Additionally, understanding global investment trends can help investors navigate market volatility and mitigate risks.

Impact of Economic Conditions on Global Investment Trends

Economic conditions play a significant role in shaping global investment trends. Factors such as interest rates, inflation, and GDP growth can impact investor behavior and asset prices. Here are some key points to consider:

- Low interest rates can lead to increased borrowing and investment activity.

- High inflation rates may erode the real value of investments.

- Strong GDP growth can attract foreign investment and drive up asset prices.

It is crucial for investors to monitor economic indicators and trends to anticipate market movements and make strategic investment decisions.

Geopolitical Events and Global Investment Trends

Geopolitical events can create uncertainty in the markets and influence global investment trends. Here are some ways in which geopolitical events can impact investments:

- Trade tensions between countries can disrupt supply chains and affect global trade.

- Political instability in a region can lead to increased risk aversion among investors.

- Global conflicts or natural disasters can cause market volatility and impact asset prices.

Investors should consider the geopolitical landscape when assessing investment opportunities and managing risks in their portfolios.

Types of Global Investments

Investing globally offers a wide range of opportunities for investors looking to diversify their portfolios and potentially earn higher returns. Here are some common types of global investments and the risks associated with each:

Stocks

- Stocks represent ownership in a company and can be bought and sold on stock exchanges around the world.

- Risks: Stock prices can be volatile, influenced by factors like economic conditions, company performance, and market sentiment.

Bonds

- Bonds are debt securities issued by governments or corporations to raise capital, with investors lending money in exchange for periodic interest payments.

- Risks: Bond prices can be affected by interest rate changes, credit risk, and inflation, impacting the overall return on investment.

Real Estate

- Investing in real estate involves purchasing properties like residential homes, commercial buildings, or land for rental income or capital appreciation.

- Risks: Real estate investments can be influenced by factors such as location, property market trends, and maintenance costs.

Diversification is key in global investment strategies as it helps spread risks across different asset classes and regions. By investing in a mix of stocks, bonds, and real estate globally, investors can potentially minimize losses from any single investment and capitalize on opportunities in various markets.

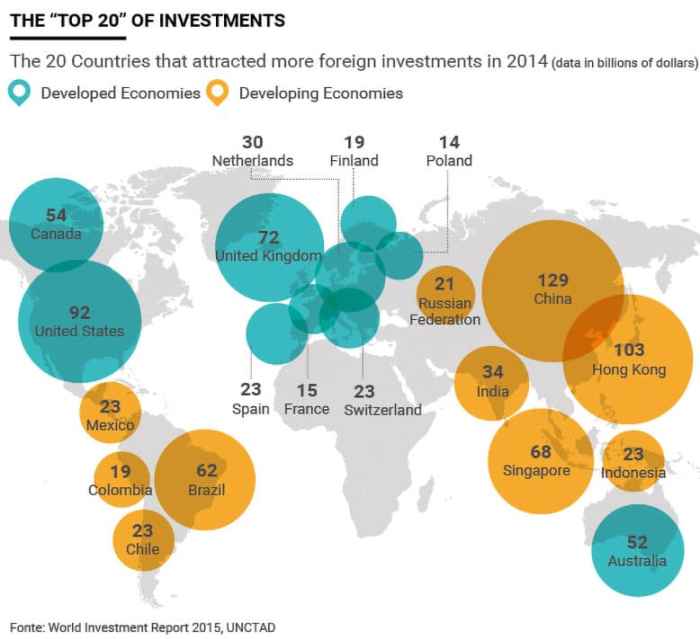

Regional Investment Trends

Investing in different regions around the world can offer unique opportunities and challenges. Geopolitical events play a significant role in shaping investment trends in major regions such as Asia, Europe, and North America. Understanding the differences in investment approaches across these regions is crucial for successful global investing.

Asia

Asia has been a hotbed for investment in recent years, with countries like China, Japan, and India attracting a lot of attention from investors. The region’s rapid economic growth, expanding middle class, and technological advancements make it an attractive destination for both foreign and domestic investments. However, geopolitical tensions, trade disputes, and regulatory changes can impact investment opportunities in Asia.

Europe

Europe is known for its diverse investment landscape, with countries like Germany, the UK, and France offering a wide range of investment options. The region’s stable economy, strong regulatory framework, and access to skilled labor make it an appealing choice for investors. However, factors like Brexit, political instability, and changing regulations can influence investment decisions in Europe.

North America

North America, particularly the United States and Canada, remains a key destination for investors seeking stable returns and innovative opportunities. The region’s strong financial markets, technological advancements, and entrepreneurial spirit make it a favorable choice for both domestic and international investors. However, factors like trade policies, interest rates, and political developments can impact investment trends in North America.

Emerging Technologies and Global Investment Trends

In today’s fast-paced world, emerging technologies have a significant impact on global investment trends. From AI to blockchain, these innovations are reshaping the landscape of investments and opening up new opportunities for investors.

AI and Global Investment Trends

AI, or artificial intelligence, is revolutionizing the way investment decisions are made. With the ability to analyze vast amounts of data in real-time, AI-powered algorithms can identify trends, patterns, and potential investment opportunities that human investors might overlook. This technology has the potential to enhance the efficiency and accuracy of investment strategies, leading to better returns for investors.

Blockchain Technology in Global Investments

Blockchain technology, known primarily for its role in cryptocurrencies, is also making waves in the investment world. By providing a secure and transparent way to record transactions, blockchain is transforming how investments are managed and tracked. Smart contracts built on blockchain technology can automate processes, reduce costs, and minimize the risk of fraud, making it an attractive option for investors looking for increased security and efficiency.

Fintech Innovations and Global Investments

Fintech, a combination of finance and technology, is disrupting traditional investment practices. Through the use of mobile apps, robo-advisors, and online platforms, fintech companies are democratizing access to investment opportunities and providing personalized investment solutions to a wider audience. These innovations are streamlining the investment process, making it more convenient and accessible for both seasoned investors and newcomers alike.

Examples of Technological Impact on Global Investments

– Algorithmic trading platforms leveraging AI for real-time market analysis.

– Cryptocurrency exchanges utilizing blockchain technology for secure transactions.

– Robo-advisors offering automated investment recommendations based on individual risk profiles.

– Crowdfunding platforms using fintech solutions to connect investors with startups and small businesses.