Yo, listen up! Financial markets basics are about to drop some serious knowledge bombs. From defining what financial markets are to exploring different investment strategies, this topic is straight fire. So buckle up and get ready to dive into the world of finance like never before.

In this guide, we’ll break down everything you need to know about financial markets basics, from the key players to market structure and functionality. Get ready to level up your financial literacy game!

Overview of Financial Markets Basics

Financial markets play a crucial role in the economy by facilitating the buying and selling of various financial assets such as stocks, bonds, currencies, and commodities. These markets allow individuals, businesses, and governments to raise capital, manage risks, and invest in opportunities.

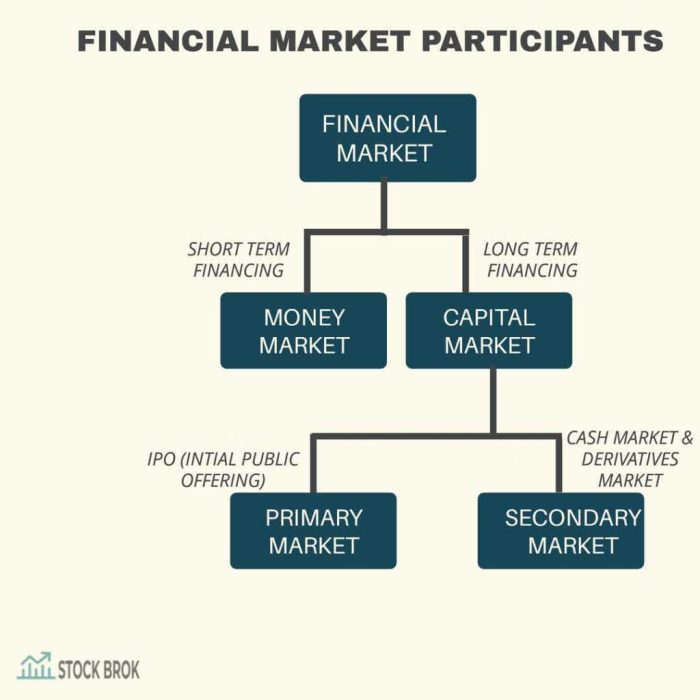

Types of Financial Markets

- The Stock Market: This is where shares of publicly traded companies are bought and sold. Investors can purchase ownership stakes in companies and potentially earn returns through dividends and capital gains.

- The Bond Market: In this market, debt securities issued by governments, corporations, and other entities are traded. Bonds represent loans that investors provide to these entities, who promise to repay the principal amount plus interest over time.

- The Money Market: This market deals with short-term debt securities with maturities typically less than one year. Participants use the money market to borrow and lend cash for short periods, often to meet liquidity needs or manage cash flow.

Examples of financial instruments traded in these markets include stocks, corporate bonds, treasury bills, options, futures contracts, and foreign exchange.

Participants in Financial Markets

In the world of financial markets, there are various key players who play vital roles in shaping the dynamics of the market. These participants include investors, traders, brokers, and regulators, each with their own unique responsibilities and impact on the market.

Investors

Investors are individuals or institutions who allocate capital with the expectation of generating a return on their investment. They can be classified into different categories based on their investment objectives, risk tolerance, and investment horizon. Investors provide liquidity to the market by buying and selling financial instruments, which in turn influences the prices of these assets.

Traders

Traders are individuals or firms that actively buy and sell financial instruments in the market with the goal of making profits from short-term price movements. They play a crucial role in ensuring market efficiency by facilitating the smooth functioning of transactions. Traders can be categorized into various types such as day traders, swing traders, and algorithmic traders, each employing different strategies to capitalize on market opportunities.

Brokers

Brokers act as intermediaries between buyers and sellers in the financial markets. They execute trades on behalf of their clients and provide them with access to various financial products and services. Brokers play a critical role in ensuring transparency, efficiency, and fairness in the market by facilitating the smooth execution of trades and providing valuable market insights to their clients.

Regulators

Regulators are government agencies or regulatory bodies responsible for overseeing and enforcing the rules and regulations that govern the financial markets. They play a crucial role in maintaining market integrity, protecting investors’ interests, and ensuring fair and orderly trading practices. Regulators monitor the activities of market participants, investigate any potential misconduct or fraud, and impose sanctions or penalties on violators to maintain market stability and confidence.

Market Structure and Functionality

Financial markets are structured in various ways, including centralized exchanges and over-the-counter markets. Centralized exchanges are physical or electronic locations where buyers and sellers come together to trade financial instruments such as stocks, bonds, and derivatives. On the other hand, over-the-counter markets are decentralized networks where trading occurs directly between parties without a centralized exchange.

Functions of Financial Markets

Financial markets play a crucial role in allocating capital efficiently by connecting savers and investors. They provide a platform for companies and governments to raise funds for projects and investments through the issuance of stocks and bonds. Additionally, financial markets help in managing risk by allowing individuals and institutions to hedge against price fluctuations and other uncertainties through the use of derivatives.

- Facilitating capital allocation: Financial markets enable the flow of capital from savers to borrowers, ensuring that funds are allocated to their most productive uses.

- Providing liquidity: Markets offer liquidity, allowing investors to buy and sell financial assets quickly and easily.

- Price discovery: Through the interaction of buyers and sellers, financial markets determine the fair value of assets, leading to efficient price discovery.

Impact of Market Structure

The market structure has a significant impact on liquidity and price discovery. In centralized exchanges, trading is standardized and transparent, leading to higher liquidity as there is a central location for buyers and sellers to meet. On the other hand, over-the-counter markets may have lower liquidity due to the decentralized nature of trading. Price discovery is also influenced by market structure, with centralized exchanges often providing more accurate and timely price information compared to over-the-counter markets.

Investment Strategies in Financial Markets

Investment strategies in financial markets refer to the various approaches investors use to make decisions about buying, selling, and holding assets with the goal of generating profits. These strategies can range from long-term value investing to short-term day trading, each with its own risk and return profile.

Types of Investment Strategies

- Value Investing: This strategy involves identifying undervalued assets that have the potential to increase in value over time. Investors following this approach look for stocks trading below their intrinsic value.

- Growth Investing: Growth investors focus on companies that demonstrate strong potential for expansion and capital appreciation. They prioritize companies with high revenue and earnings growth rates.

- Day Trading: Day traders buy and sell financial instruments within the same trading day to capitalize on short-term price fluctuations. This strategy requires quick decision-making and a high tolerance for risk.

Risk-Return Tradeoff in Investment Decisions

The risk-return tradeoff is a fundamental concept in investing that suggests a higher return is typically associated with a higher level of risk. Investors must weigh the potential returns of an investment against the likelihood of incurring losses. Higher-risk investments generally offer the potential for greater returns, but they also come with an increased chance of losing money.

Market Trends Influence on Investment Strategies

Market trends play a crucial role in shaping investment strategies. For example, during periods of economic expansion, growth investing may be more favorable as companies experience increased profitability. Conversely, during economic downturns, value investing might be a more prudent approach as investors seek out bargains in a declining market.

Market Analysis and Research

Market analysis plays a crucial role in helping investors make informed decisions regarding their investments. By examining various market factors and trends, investors can better understand the risks and opportunities associated with different assets.

Methods of Market Research

- Fundamental Analysis: This method involves evaluating the financial health and performance of a company, including factors such as revenue, earnings, and market share. Investors using fundamental analysis aim to determine the intrinsic value of a stock or asset.

- Technical Analysis: In contrast, technical analysis focuses on analyzing past market data, such as price and volume, to predict future price movements. This method relies on charts and indicators to identify patterns and trends in the market.

Impact of Economic Indicators and News

- Economic Indicators: Indicators such as GDP growth, inflation rates, and employment figures can have a significant impact on market behavior. Positive or negative economic data can influence investor sentiment and market direction.

- News Events: News related to geopolitical events, corporate earnings, or changes in government policies can also affect market movements. Investors need to stay informed about such developments to make timely and informed investment decisions.

Market Regulations and Compliance

The financial markets are governed by a set of regulations designed to ensure fair and efficient operations. These regulations play a crucial role in maintaining market integrity and protecting investors.

Role of Regulations

Regulations help establish a level playing field for all participants in the financial markets. They set standards for transparency, disclosure, and conduct, reducing the likelihood of fraud or manipulation. By enforcing rules and guidelines, regulators aim to promote trust and confidence in the markets.

- Regulations prevent insider trading, market abuse, and other unethical practices.

- They require companies to disclose relevant information to investors, promoting informed decision-making.

- Regulatory bodies monitor compliance and investigate any violations to uphold market integrity.

Impact of Compliance Requirements

Market participants, including individuals, institutions, and corporations, must adhere to regulatory requirements to operate in the financial markets. Compliance obligations can have significant implications on their activities and strategies.

- Compliance costs can impact the profitability of firms, especially smaller businesses with limited resources.

- Failure to comply with regulations can result in fines, sanctions, or even legal action, damaging reputations and financial stability.

- Compliance requirements may influence investment decisions, risk management practices, and overall business operations.

Recent Regulatory Developments

Regulatory frameworks in financial markets are constantly evolving to address emerging risks and challenges. Recent developments have introduced changes that shape the landscape for market participants and regulators alike.

- The implementation of MiFID II in Europe aimed to enhance transparency and investor protection in trading activities.

- The SEC’s focus on cybersecurity regulations reflects the growing concern over data breaches and cyber threats in the financial industry.

- Global efforts to combat money laundering and terrorist financing have led to stricter regulatory requirements for financial institutions worldwide.

Risks and Challenges in Financial Markets

When it comes to investing in financial markets, there are various risks and challenges that investors need to be aware of and navigate effectively. Understanding these risks and challenges is crucial for making informed investment decisions and managing potential uncertainties.

Common Risks Faced by Investors

- Market Risk: This refers to the possibility of financial losses due to movements in the overall market, influenced by factors such as economic indicators, interest rates, and political events.

- Credit Risk: This is the risk of loss resulting from a borrower failing to repay a loan or meet contractual obligations, affecting bondholders or lenders.

Challenges in Financial Markets

- Volatility: Market volatility can lead to unpredictable price fluctuations, impacting investment returns and creating uncertainty for investors.

- Liquidity Issues: Limited liquidity in certain assets can make it challenging to buy or sell investments quickly without significantly affecting their prices.

- Geopolitical Events: Political instability, trade tensions, or conflicts can create uncertainties in financial markets, impacting investor confidence and market performance.

Strategies for Managing Risks and Navigating Challenges

- Diversification: Spreading investments across different asset classes can help reduce overall risk exposure and minimize the impact of market fluctuations on a single investment.

- Risk Assessment: Conducting thorough risk assessments and understanding the risk-return profile of investments can help investors make informed decisions aligned with their risk tolerance.

- Monitoring and Adaptation: Regularly monitoring market conditions, staying informed about economic trends, and adjusting investment strategies accordingly can help mitigate risks and capitalize on opportunities.