Diving into the world of APR on loans, this guide will break down the nitty-gritty details in a way that’s easy to grasp. From deciphering the difference between APR and interest rates to understanding how it impacts your financial decisions, get ready to level up your loan knowledge game.

What is APR on loans?

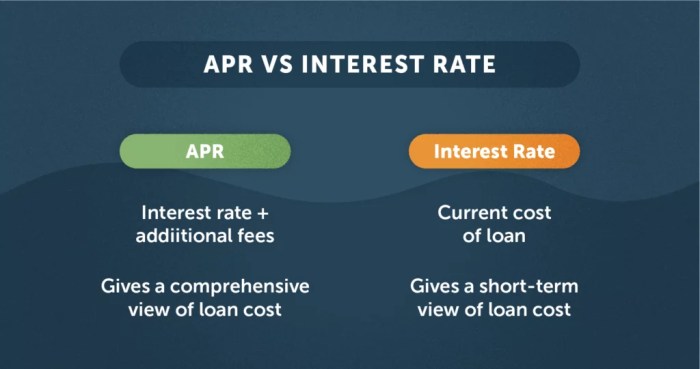

When we talk about APR on loans, we’re looking at the Annual Percentage Rate, which is the total cost of borrowing money expressed as an annual percentage. It includes the interest rate as well as any additional fees that may be charged by the lender. This gives borrowers a more accurate picture of how much they will actually pay to borrow money.

APR differs from interest rates because it takes into account not just the interest charged on the loan, but also any other fees or charges that are associated with borrowing. This means that two loans with the same interest rate could have different APRs if one lender charges higher fees than the other.

Understanding APR is crucial for borrowers because it allows them to compare the true cost of borrowing money from different lenders. By looking at the APR, borrowers can see the total cost of the loan and make more informed decisions about which loan offer is the best fit for their financial situation.

Importance of APR

- APR provides a more comprehensive view of the cost of borrowing money compared to just looking at the interest rate.

- It helps borrowers compare different loan offers more accurately, taking into account all associated fees.

- Understanding APR can help borrowers avoid hidden costs and make better financial decisions.

Components of APR

When looking at the Annual Percentage Rate (APR) on loans, it is important to understand the various components that make up this figure. The APR includes not only the interest rate on the loan but also any additional fees and charges associated with borrowing money.

Interest Rate

The interest rate is the percentage of the loan amount that the lender charges for borrowing the money. This is a significant component of the APR and directly impacts the total cost of borrowing.

Origination Fees

Origination fees are charges imposed by the lender for processing a new loan. These fees are typically calculated as a percentage of the total loan amount and are included in the APR calculation.

Discount Points

Discount points are fees paid to the lender at closing in exchange for a lower interest rate. Each point typically costs 1% of the total loan amount and can reduce the interest rate by a certain percentage.

Broker Fees

Broker fees are charges paid to a loan broker for their services in arranging a loan. These fees are also factored into the APR calculation and add to the overall cost of borrowing.

Other Charges

In addition to the above components, other charges such as application fees, appraisal fees, and credit report fees may also be included in the APR calculation. These additional costs can significantly impact the total APR on a loan.

Summary

The APR on loans is a comprehensive figure that includes not only the interest rate but also various fees and charges associated with borrowing money. By understanding the components of APR, borrowers can make more informed decisions when comparing loan offers and determining the total cost of borrowing.

Calculating APR

When it comes to calculating APR on loans, it’s important to understand the formula used to determine this crucial number. APR takes into account not only the interest rate on a loan but also any additional fees or costs associated with borrowing money.

Formula for Calculating APR

To calculate APR, you can use the following formula:

APR = [(Total Interest + Total Fees) / Loan Amount] x (365 / Days Loan is Outstanding) x 100

This formula considers the total interest paid over the life of the loan, any fees charged by the lender, the loan amount, and the number of days the loan is outstanding. By factoring in all these components, APR provides a more comprehensive view of the true cost of borrowing.

Impact of Loan Term and Fees on APR

The loan term and any additional fees can significantly impact the APR on a loan. A longer loan term typically results in a higher APR, as more interest will accrue over time. Similarly, higher fees can also increase the APR, as they add to the overall cost of borrowing.

Calculating APR Examples

- Example 1: A $10,000 loan with 5% interest and $500 in fees, to be repaid over 1 year.

- Total Interest = $10,000 x 0.05 = $500

- APR = [($500 + $500) / $10,000] x (365 / 365) x 100 = 10%

- Example 2: A $5,000 loan with 7% interest and $200 in fees, to be repaid over 6 months.

- Total Interest = $5,000 x 0.07 = $350

- APR = [($350 + $200) / $5,000] x (365 / 182) x 100 = 18%

Importance of APR

Understanding APR is crucial for making informed financial decisions. It gives you a clear picture of the true cost of borrowing money and allows you to compare different loan options effectively.

Significance of APR for Financial Decision-Making

Knowing the APR helps you determine the total amount you will pay back over the life of a loan. Even a small difference in APR can result in significant savings or extra costs, depending on the loan term and amount borrowed.

- APR Impact on Total Cost:

APR includes not only the interest rate but also any additional fees or charges associated with the loan. This comprehensive view helps you understand the overall cost of borrowing and choose the most cost-effective option.

- Comparing Loan Affordability:

By considering the APR, you can assess the affordability of different loans accurately. A lower APR usually means lower monthly payments and less interest paid over time.

- Real-Life Examples:

For instance, a car loan with a 5% APR will cost less in interest than a similar loan with a 10% APR, saving you money in the long run.

Comparing Loans Based on APR

When comparing loans, it’s crucial to look at the Annual Percentage Rate (APR) rather than just the interest rate. The APR includes not only the interest rate but also any additional fees or charges associated with the loan. This provides a more accurate representation of the total cost of borrowing.

Why Comparing APR is More Accurate

- APR accounts for all costs: By considering both the interest rate and any fees, the APR gives a comprehensive view of the total cost of the loan.

- Standardized comparison: Since the APR includes all costs, it provides a standardized metric for comparing different loan offers.

- Reflects the true cost: Comparing loans based on APR helps borrowers understand the true cost of borrowing and make informed decisions.

How to Compare Loans Effectively

- Collect loan offers: Gather information on the interest rates, fees, and terms of each loan you are considering.

- Calculate the APR: Use the formula to calculate the APR for each loan offer. This will give you a clear comparison of the total cost.

- Consider repayment terms: Look at the repayment schedule and total amount payable for each loan to understand the impact on your finances.

- Choose the best option: After comparing the APRs of different loan offers, select the one that best fits your financial situation and needs.