How to get a mortgage loan sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

If you’ve ever wondered about the ins and outs of securing a mortgage loan, you’re in for a treat. From understanding the basics to navigating the application process, this guide has got you covered.

Understanding Mortgage Loans

When it comes to buying a home, most people don’t have enough cash on hand to pay for the entire purchase upfront. That’s where mortgage loans come in. A mortgage loan is a type of loan specifically used to purchase real estate, where the borrower agrees to repay the loan amount plus interest over a set period of time.

Types of Mortgage Loans

- Fixed-Rate Mortgages: These mortgages have a fixed interest rate for the entire term of the loan, making it easier to budget since the monthly payments remain the same.

- Adjustable-Rate Mortgages (ARMs): These mortgages have an interest rate that can change periodically based on market conditions, which can lead to fluctuating monthly payments.

- VA Loans: These loans are guaranteed by the U.S. Department of Veterans Affairs and are available to eligible veterans, active-duty service members, and certain military spouses.

- FHA Loans: These loans are insured by the Federal Housing Administration and are popular among first-time homebuyers due to their lower down payment requirements.

Factors Influencing Mortgage Loan Eligibility

- Credit Score: Your credit score plays a significant role in determining your eligibility for a mortgage loan. A higher credit score typically leads to better loan terms and lower interest rates.

- Income and Employment History: Lenders will look at your income and employment history to ensure that you have a stable source of income to repay the loan.

- Debt-to-Income Ratio: Lenders will also consider your debt-to-income ratio, which is the percentage of your monthly income that goes towards paying off debts. A lower ratio is generally more favorable.

Preparing for a Mortgage Loan

When it comes to preparing for a mortgage loan, there are a few key steps you can take to improve your chances of approval and secure a loan that works for you.

Improving Credit Score

One important factor in getting approved for a mortgage loan is your credit score. Lenders use this to determine your creditworthiness and the interest rate you qualify for. To improve your credit score:

- Pay your bills on time

- Reduce your debt-to-income ratio

- Check your credit report for errors

Saving for a Down Payment

Saving for a down payment is crucial when applying for a mortgage loan. A larger down payment can lower your monthly payments and interest rates. Here are some tips to help you save:

- Set a savings goal and budget

- Cut unnecessary expenses

- Consider additional sources of income

Calculating Affordability

It’s essential to determine how much mortgage you can afford before applying for a loan. This will help you set a realistic budget and avoid overextending yourself financially. To calculate affordability:

- Consider your income, expenses, and debts

- Use a mortgage calculator to estimate monthly payments

- Factor in property taxes, insurance, and other costs

Finding the Right Lender

Finding the right lender is crucial when applying for a mortgage loan. Different types of lenders offer various terms and rates, so it’s essential to compare and choose the best option for your financial situation.

Types of Lenders

- Banks: Traditional banks offer mortgage loans and may have strict requirements.

- Credit Unions: Credit unions are member-owned and may offer more personalized service.

- Online Lenders: Online lenders often have competitive rates and streamlined application processes.

Required Documents

- Income Verification: Pay stubs, tax returns, and bank statements.

- Credit History: Credit reports and scores.

- Asset Documentation: Details of savings, investments, and other assets.

- Employment Verification: Proof of employment and income stability.

Importance of Shopping Around

Shopping around for the best mortgage rates can save you thousands of dollars over the life of the loan. Even a small difference in interest rates can have a significant impact on your monthly payments and overall loan cost. Be sure to compare offers from multiple lenders to find the most favorable terms for your financial situation.

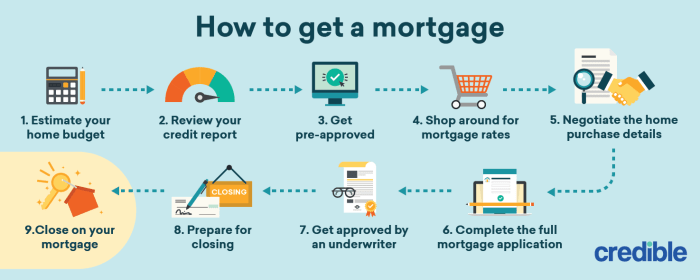

The Mortgage Application Process

When it comes to applying for a mortgage loan, there are several steps involved in the process. From gathering necessary documents to meeting with a lender, each step plays a crucial role in securing approval for your mortgage.

Steps Involved in Applying for a Mortgage Loan

- Gather necessary documents such as pay stubs, tax returns, and bank statements.

- Complete a loan application with accurate information about your income, assets, and debts.

- Meet with a lender to discuss your mortgage options and get pre-approved for a loan amount.

- Submit additional documents as requested by the lender for further verification.

- Undergo a home appraisal to determine the value of the property you wish to purchase.

- Wait for the lender to review your application and provide an approval decision.

Timeline for Mortgage Approval

- The timeline for mortgage approval can vary depending on factors such as the complexity of your financial situation and the lender’s workload.

- On average, the mortgage approval process can take anywhere from 30 to 45 days from the time you submit your application.

- Factors that can affect the timeline include the need for additional documentation, property appraisals, and underwriting processes.

Role of a Mortgage Broker

- A mortgage broker acts as an intermediary between you and potential lenders, helping you find the best mortgage loan options.

- Brokers have access to a network of lenders and can help you navigate the application process more efficiently.

- Brokers can also assist in comparing loan offers, negotiating terms, and securing competitive rates for your mortgage.

Understanding Mortgage Rates

When it comes to getting a mortgage loan, understanding mortgage rates is crucial. Mortgage rates can significantly impact the total amount you pay over the life of your loan. Here’s what you need to know about how mortgage rates are determined and the different types of rates available to borrowers.

How Mortgage Rates are Determined

Mortgage rates are influenced by various factors, including the overall economy, inflation rates, the Federal Reserve’s monetary policy, and the demand for mortgages. Lenders also consider your credit score, loan amount, loan term, and the type of loan you choose when determining your interest rate.

- Market Conditions: Mortgage rates tend to rise and fall based on market conditions and economic indicators.

- Loan Type: Different types of loans, such as FHA, VA, or conventional loans, may have varying interest rates.

- Credit Score: A higher credit score typically results in a lower interest rate, as it indicates a lower risk for the lender.

Fixed-Rate vs. Adjustable-Rate Mortgages

There are two primary types of mortgage rates: fixed-rate and adjustable-rate mortgages.

- Fixed-Rate Mortgages: With a fixed-rate mortgage, your interest rate remains the same throughout the life of the loan. This provides stability and predictability in your monthly payments.

- Adjustable-Rate Mortgages (ARMs): ARMs have interest rates that can change periodically based on market conditions. While initial rates may be lower, they can increase over time, potentially leading to higher payments.

Tips on When to Lock in a Mortgage Rate

It’s essential to know when to lock in a mortgage rate to secure a favorable rate for your loan.

- Monitor Market Trends: Keep an eye on market trends and interest rate movements to determine the best time to lock in your rate.

- Consult with Your Lender: Work closely with your lender to understand current rates and discuss the best timing for locking in your rate.

- Consider Your Financial Goals: Evaluate your financial goals and how different rate options align with your long-term plans.

Mortgage Loan Approval

When it comes to mortgage loan approval, there are several factors that can influence whether or not your application is successful. Lenders consider things like your credit score, income, employment history, debt-to-income ratio, and the amount of down payment you can provide.

Importance of Pre-Approval versus Pre-Qualification

- Pre-approval involves a more thorough review of your financial situation by a lender, including a credit check and verification of your income and assets. This gives you a more accurate idea of how much you can borrow.

- Pre-qualification is a more basic assessment based on information you provide to the lender. While it can give you an estimate of what you might qualify for, it is not a guarantee of a loan amount.

Tips if Your Mortgage Loan Application is Denied

- Find out why your application was denied. This can help you address any issues and improve your chances in the future.

- Work on improving your credit score by paying down debt, making payments on time, and avoiding new credit inquiries.

- Save for a larger down payment, as this can help offset a lower credit score or other financial issues.

- Consider finding a co-signer with good credit to help strengthen your application.

- Shop around for other lenders who may have different approval criteria or programs that better fit your financial situation.