As dividend growth investing takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Diving into the realm of dividend growth investing unveils a strategy that goes beyond traditional investment approaches, offering a unique perspective on building wealth through sustainable income streams.

Introduction to Dividend Growth Investing

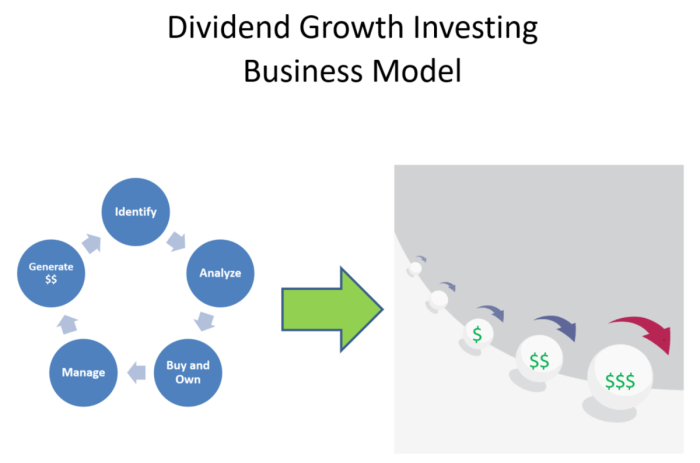

Dividend growth investing is a strategy where investors focus on purchasing stocks that have a track record of consistently increasing their dividend payments over time. This approach emphasizes the importance of receiving a steady income stream from investments while also benefiting from potential capital appreciation.

Core Principles of Dividend Growth Investing

- Investing in companies with a history of increasing dividends

- Emphasizing long-term growth and stability

- Reinvesting dividends to compound returns

Importance of Dividend Growth Investing in a Portfolio

Dividend growth investing can provide a reliable source of income, especially during market downturns, making it an essential component of a diversified portfolio. By focusing on companies with a commitment to growing dividends, investors can potentially benefit from both income and capital appreciation.

Benefits of Focusing on Dividend Growth Stocks

- Historically outperforming non-dividend-paying stocks

- Offering a hedge against inflation

- Providing a sense of stability and predictability in returns

Selecting Dividend Growth Stocks

When it comes to selecting dividend growth stocks, there are key metrics that investors should consider in order to make informed decisions. By comparing criteria for shortlisting dividend growth companies and looking at examples of industries that often feature strong dividend growth stocks, investors can build a solid portfolio for the long term.

Key Metrics for Evaluating Dividend Growth Stocks

- Dividend Yield: The percentage of a company’s stock price that is paid out as dividends annually. A higher dividend yield may indicate a better return on investment.

- Dividend Growth Rate: The rate at which a company has increased its dividends over time. Consistent and sustainable dividend growth is a positive sign.

- Payout Ratio: The percentage of earnings paid out as dividends. A lower payout ratio suggests that the company has room to continue increasing dividends.

- Dividend History: Looking at a company’s track record of paying dividends can provide insight into its commitment to rewarding shareholders.

Criteria for Shortlisting Dividend Growth Companies

- Stable and Growing Earnings: Companies with consistent and growing earnings are more likely to sustain dividend growth.

- Strong Balance Sheet: A healthy balance sheet with manageable debt levels is important for dividend sustainability.

- Industry Trends: Investing in industries with favorable growth prospects can lead to higher dividend growth.

- Management Quality: Competent management that prioritizes shareholder returns is crucial for dividend growth stocks.

Industries with Strong Dividend Growth Stocks

- Consumer Staples: Companies in this sector often have stable cash flows and consistent demand for their products.

- Utilities: Regulated utilities tend to offer steady income and have a history of paying dividends.

- Healthcare: Healthcare companies with strong cash flows and growing demand for services can be attractive dividend growth investments.

- Technology: Some tech companies have started paying dividends as they mature, offering potential for dividend growth.

Strategies for Dividend Growth Investing

Diving into the world of dividend growth investing requires a solid strategy to ensure long-term success. Let’s explore different approaches to incorporating dividend growth stocks into your investment portfolio and how to make the most out of dividend reinvestment plans (DRIPs).

Balancing Dividend Yield and Dividend Growth Rate

When selecting dividend growth stocks, it’s essential to strike a balance between dividend yield and dividend growth rate. While high dividend yield may seem attractive, a high yield could indicate that the stock price has dropped significantly. On the other hand, a high dividend growth rate signals a healthy and growing company. Look for stocks that offer a combination of steady dividend yield and consistent dividend growth over time.

Utilizing Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) are a valuable tool for dividend growth investors. With DRIPs, you can automatically reinvest your dividends back into the same company’s stock without incurring additional fees. This allows you to benefit from compound growth as your investment grows over time. DRIPs are particularly useful for long-term investors looking to maximize their returns through the power of compounding.

Sector Diversification

Diversifying your dividend growth stock portfolio across different sectors can help mitigate risk and enhance long-term returns. By investing in companies from various sectors such as healthcare, technology, consumer goods, and finance, you can spread out your risk and capitalize on different market trends. Keep an eye on sector performance and adjust your portfolio allocation accordingly to maintain a well-balanced and diversified portfolio.

Focus on Quality Companies

When selecting dividend growth stocks, prioritize quality companies with strong fundamentals and a proven track record of increasing dividends over time. Look for companies with stable cash flow, low debt levels, and a history of consistent dividend payments. Quality companies are more likely to weather economic downturns and continue to grow their dividends, providing you with a reliable stream of income in the long run.

Risks and Challenges in Dividend Growth Investing

When it comes to dividend growth investing, there are certain risks and challenges that investors need to be aware of in order to make informed decisions and mitigate potential losses.

Potential Risks Associated with Dividend Growth Investing

- Market Volatility: Fluctuations in the stock market can impact the value of dividend-paying stocks, leading to potential losses.

- Dividend Cuts: Companies may reduce or eliminate dividend payments due to financial difficulties, impacting investors’ income.

- Interest Rate Changes: Rising interest rates can make dividend stocks less attractive compared to fixed-income investments.

- Company Performance: Poor financial performance or mismanagement by companies can lead to a decrease in dividends.

Strategies for Mitigating Risks when Investing in Dividend Growth Stocks

- Diversification: Spread investments across different sectors and industries to reduce the impact of a single stock’s performance.

- Research and Due Diligence: Conduct thorough research on companies before investing to assess their financial health and dividend history.

- Monitor Investments: Stay informed about market trends and company updates to make timely decisions and adjust your portfolio as needed.

- Reinvest Dividends: Reinvesting dividends can help compound your returns over time and mitigate the impact of market volatility.

Impact of Economic Cycles on Dividend Growth Investments

Economic cycles, such as recessions or expansions, can influence dividend growth investments in various ways. During economic downturns, companies may struggle to maintain or increase dividend payments, leading to potential cuts. Conversely, in periods of economic growth, companies may have more resources to increase dividends, benefiting investors. Understanding the impact of economic cycles on dividend growth investments is crucial for making informed decisions and adapting your investment strategy accordingly.