Diving into the world of investing, dollar-cost averaging emerges as a powerful tool for building wealth over time. This strategy involves investing a fixed amount at regular intervals, regardless of market conditions, allowing you to benefit from the natural ebbs and flows of the market. Let’s explore how this method can help you navigate the unpredictable waters of investing with confidence and ease.

As we delve deeper into the concept of dollar-cost averaging, you’ll discover the ins and outs of this strategy and how it can potentially lead to long-term financial success.

What is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy where an investor divides up the total amount to be invested across periodic purchases of a target asset. This approach helps reduce the impact of volatility on the overall purchase price.

How Dollar-Cost Averaging Works

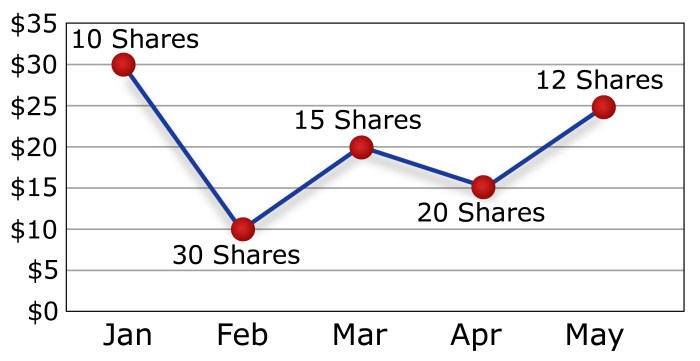

Dollar-cost averaging works by consistently investing a fixed amount of money at regular intervals, regardless of the asset’s price. This means that more units of the asset are purchased when prices are low and fewer units when prices are high. Over time, this strategy can potentially lower the average cost per unit of the asset.

- For example, let’s say an investor decides to invest $100 in a particular stock every month. If the stock price is $10 in the first month, the investor will purchase 10 shares. If the price drops to $5 in the second month, the investor will purchase 20 shares. This averages out to 15 shares at an average cost of $6.67 per share.

- Another example could be investing $500 in a mutual fund every quarter. Regardless of whether the price per unit of the mutual fund goes up or down, the investor will consistently invest the same amount. This can help mitigate the risk of making a large lump-sum investment at the wrong time.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging offers several advantages for investors looking to mitigate risks and build wealth steadily over time.

Diversification of Investment Risk

When using dollar-cost averaging, investors spread out their purchases over time, reducing the impact of market volatility on their portfolio. This diversification helps minimize the risk of investing a large sum of money at the wrong time.

Emotional Discipline

By sticking to a regular investment schedule, dollar-cost averaging helps investors avoid making emotional decisions based on market fluctuations. This disciplined approach can prevent panic selling during market downturns and keep investors focused on their long-term goals.

Potential for Lower Average Cost

Dollar-cost averaging allows investors to buy more shares when prices are low and fewer shares when prices are high. Over time, this strategy can result in a lower average cost per share compared to lump-sum investing.

Long-Term Wealth Building

For investors looking to build wealth over the long term, dollar-cost averaging provides a consistent and disciplined approach to investing. By investing regularly, individuals can take advantage of compound interest and dollar-cost averaging to grow their portfolio steadily over time.

Real-Life Scenario

Consider an investor who started investing $500 every month in a diversified portfolio using dollar-cost averaging. During a market downturn, the investor was able to buy more shares at lower prices. As the market recovered, the investor saw significant gains due to the lower average cost of their shares.

Risks and Considerations

When it comes to dollar-cost averaging, there are some risks and considerations to keep in mind. While this strategy can help reduce the impact of market volatility, it is not without its potential downsides.

Market Volatility

One of the main risks associated with dollar-cost averaging is market volatility. Fluctuations in the market can impact the overall performance of your investments, especially if you are consistently buying at higher prices during a downturn.

Timing the Market

Another consideration is the difficulty of timing the market. Since dollar-cost averaging involves making regular investments regardless of market conditions, you may miss out on opportunities to buy at lower prices or avoid investing at the peak of a market cycle.

Long-Term Commitment

Using dollar-cost averaging requires a long-term commitment to the strategy. If you decide to stop investing or pull out your funds prematurely, you may not fully benefit from the potential advantages of this approach.

Mitigating Risks

- Consider diversifying your investments to spread risk across different asset classes.

- Stay informed about market trends and adjust your investment strategy accordingly.

- Regularly review and reassess your financial goals to ensure that dollar-cost averaging aligns with your objectives.

Implementing Dollar-Cost Averaging

When it comes to implementing a dollar-cost averaging plan, there are a few key steps to follow to get started. This strategy can help reduce the impact of market volatility on your investments over time.

Steps to Start a Dollar-Cost Averaging Plan

- Choose the investment or asset you want to regularly invest in.

- Select a brokerage or investment platform that offers dollar-cost averaging services.

- Set up automatic recurring purchases at regular intervals (weekly, monthly, etc.).

- Monitor your investments periodically to track progress and make adjustments if needed.

Sample Dollar-Cost Averaging Schedule

| Month | Investment Amount |

|---|---|

| January | $100 |

| February | $150 |

| March | $200 |

| April | $150 |

Tools and Resources for Implementing Dollar-Cost Averaging

- Robo-advisors: Platforms like Betterment or Wealthfront offer automated investing services that include dollar-cost averaging.

- Online brokerage accounts: Platforms like Charles Schwab, Fidelity, or Vanguard provide tools to set up recurring investments.

- Investment apps: Apps like Acorns or Stash offer easy ways to start a dollar-cost averaging plan from your smartphone.