With capital appreciation strategies at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Capital appreciation is like the cool kid at school – everyone wants to be around it because it’s all about growing your money and making those dollar bills rain. So buckle up and get ready to dive into the world of building wealth and making smart investment moves.

Introduction to Capital Appreciation Strategies

Capital appreciation refers to the increase in the value of an investment over time. This can occur due to various factors such as market conditions, demand, and overall performance of the asset.

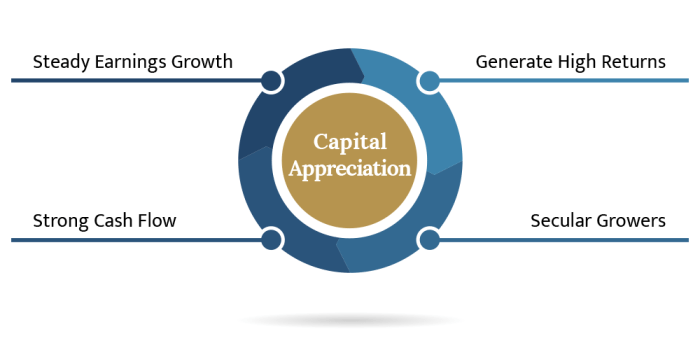

Having effective capital appreciation strategies is crucial in building wealth and achieving financial goals. By strategically investing in assets that have the potential for growth, investors can maximize their returns and increase their overall net worth.

Assets with Capital Appreciation Potential

- Stocks: Investing in stocks of companies with strong growth potential can lead to significant capital appreciation.

- Real Estate: Properties in desirable locations tend to appreciate in value over time, making real estate a popular choice for investors.

- Collectibles: Rare collectibles such as art, antiques, and vintage items can experience substantial appreciation in value.

The key principle behind capital appreciation strategies is to identify assets that have the potential for growth and hold onto them for the long term to benefit from the increase in value.

Types of Capital Appreciation Strategies

When it comes to capital appreciation strategies, there are different approaches that investors can take to grow their investments over time. Let’s explore some of the key types of strategies in this realm.

Long-Term vs. Short-Term Capital Appreciation Strategies

Long-term capital appreciation strategies involve holding onto investments for an extended period, typically several years or more, with the goal of maximizing growth over time. On the other hand, short-term strategies focus on making quick gains by buying and selling assets within a shorter timeframe, such as days, weeks, or months.

Growth Investing and Value Investing

Growth investing involves seeking out companies with high growth potential, often in emerging industries or with innovative products and services. Investors in growth stocks are willing to pay a premium for the expectation of above-average future growth. Value investing, on the other hand, focuses on finding undervalued stocks trading below their intrinsic value. Value investors believe that the market has underestimated the true worth of these companies and aim to profit from their future appreciation.

The Role of Diversification

Diversification is a key component of capital appreciation strategies as it helps spread risk across different assets, industries, and regions. By diversifying their portfolio, investors can reduce the impact of any single investment underperforming and increase the overall stability of their returns.

Risk-Return Tradeoff

Different capital appreciation strategies come with varying levels of risk and potential returns. Generally, strategies that offer higher potential returns also come with higher levels of risk. Investors need to carefully consider their risk tolerance and investment goals when choosing between different strategies to achieve the right balance between risk and return.

Implementing Capital Appreciation Strategies

When it comes to implementing capital appreciation strategies, it’s crucial to follow a systematic approach that involves thorough research, analysis, goal-setting, and continuous monitoring.

Researching Potential Investment Opportunities

Before diving into any investment opportunity, it’s essential to conduct extensive research. This includes studying the financial health of companies, analyzing market trends, and evaluating the growth potential of different sectors.

Analyzing Market Trends

To identify assets with the potential for capital appreciation, it’s important to keep a close eye on market trends. By studying historical data, understanding economic indicators, and monitoring industry news, investors can make informed decisions about where to allocate their capital.

Setting Investment Goals

Setting clear investment goals is crucial when implementing capital appreciation strategies. Whether it’s aiming for a specific rate of return, diversifying a portfolio, or achieving a certain level of wealth, having defined objectives helps investors stay focused and disciplined.

Monitoring and Adjusting Strategies

Once capital appreciation strategies are in place, it’s essential to regularly monitor their performance. By tracking the progress of investments, evaluating market conditions, and adjusting strategies as needed, investors can optimize their chances of achieving their financial goals.