Value-based investing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From understanding the concept to exploring strategies, this topic delves deep into the world of investments.

Definition of Value-Based Investing

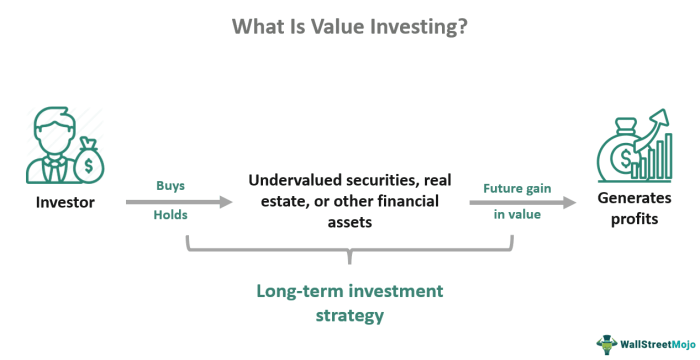

Value-based investing is a strategy where investors focus on the intrinsic value of a company’s stock rather than simply looking at its market price. The goal is to identify undervalued stocks that have the potential to increase in value over time.

Examples of Value-Based Investing Strategies

- Buying stocks of companies with strong fundamentals that are currently trading below their intrinsic value.

- Using financial ratios like Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio to identify undervalued stocks.

- Investing in companies with consistent earnings growth and solid balance sheets, even if their stock prices are temporarily depressed.

The Importance of Intrinsic Value in Value-Based Investing

Intrinsic value is the true worth of a company’s stock based on its underlying fundamentals, such as earnings, growth potential, and assets. In value-based investing, focusing on intrinsic value helps investors avoid overpaying for stocks and increases the likelihood of generating long-term returns. By determining the intrinsic value of a stock, investors can make informed decisions about buying or selling based on the underlying value of the company rather than short-term market fluctuations.

Fundamental Analysis in Value-Based Investing

Fundamental analysis plays a crucial role in value-based investing by focusing on the intrinsic value of a company’s stock. Investors using this approach analyze various financial and economic factors to determine whether a stock is undervalued or overvalued.

Key Metrics in Fundamental Analysis

Fundamental analysis involves assessing a company’s financial statements, management team, industry trends, and economic indicators to make informed investment decisions. Some key metrics used in fundamental analysis for value-based investing include:

- Earnings per share (EPS): This metric indicates a company’s profitability and helps investors assess its earning potential.

- Price-to-earnings (P/E) ratio: The P/E ratio compares a company’s stock price to its earnings per share, providing insights into its valuation.

- Debt-to-equity ratio: This ratio measures a company’s financial leverage and indicates its ability to meet its debt obligations.

- Return on equity (ROE): ROE measures a company’s profitability by assessing how effectively it generates profits from shareholders’ equity.

- Dividend yield: This metric shows the percentage of a company’s stock price that is paid out as dividends, offering insights into its dividend-paying potential.

Value Investing vs. Growth Investing

When it comes to investing, two common strategies are value investing and growth investing. Value investing focuses on finding undervalued stocks, while growth investing looks for companies with high growth potential. Let’s dive deeper into the differences between these two approaches.

Characteristics of Value-Based Companies

Value-based investing typically targets companies that are trading below their intrinsic value. These companies may have solid fundamentals, stable earnings, and consistent dividend payouts. Value investors look for bargains in the market and aim to buy low to sell high in the future.

- Companies with low price-to-earnings (P/E) ratios

- Stable and predictable cash flows

- Strong balance sheets with low debt levels

- Historically undervalued compared to industry peers

Risk Factors in Value Investing vs. Growth Investing

Value investing comes with its own set of risks compared to growth investing. While value stocks may appear cheap, there are risks associated with investing in companies that are out of favor with the market.

Value traps: Companies that are cheap for a reason, with deteriorating fundamentals or poor growth prospects.

- Value stocks may take longer to realize their true value, leading to potential opportunity costs.

- Economic downturns or industry-specific challenges can impact value stocks more significantly.

- The market may not recognize the value of a stock for an extended period, causing frustration for investors.

Value-Based Investing Strategies

Value-based investing strategies are essential for investors looking to maximize their returns by identifying undervalued assets in the market. These strategies often involve techniques such as contrarian investing, where investors go against the prevailing market sentiment to capitalize on mispriced assets.

Contrarian Investing

Contrarian investing is a value-based strategy where investors actively seek out opportunities in assets that are currently out of favor with the market. By going against the crowd, contrarian investors believe they can capitalize on the eventual correction in the asset’s valuation. This strategy requires a strong conviction in one’s analysis and the ability to withstand short-term volatility in pursuit of long-term gains.

- Contrarian investors often look for assets that have experienced a sharp decline in price due to temporary market conditions or sentiment.

- Successful contrarian investing requires a thorough understanding of the underlying fundamentals of the asset to differentiate between temporary setbacks and long-term value.

- Examples of successful contrarian investing approaches include Warren Buffett’s investments in companies like American Express during times of crisis when the market had lost confidence in the stock.

Market Volatility in Value-Based Investing Strategies

Market volatility plays a significant role in value-based investing strategies, as it can create opportunities for investors to buy undervalued assets during periods of heightened uncertainty. While volatility can lead to short-term fluctuations in asset prices, value investors often view it as a chance to acquire assets at a discount and hold them until their true value is recognized by the market.

Market volatility can be a value investor’s best friend, providing opportunities to buy quality assets at discounted prices.

- Value-based investors typically take a long-term view of their investments, focusing on the intrinsic value of assets rather than short-term price movements.

- During periods of market volatility, value investors may increase their buying activity to take advantage of lower prices and position themselves for future gains.

- Successful value-based investing strategies involve a disciplined approach to navigating market volatility and staying focused on the underlying fundamentals of the assets in which they invest.