Budget spreadsheet templates open the door to a world of financial organization and planning, offering a variety of tools and options to suit individual needs. Get ready to dive into the realm of budgeting with style and flair, as we explore the ins and outs of these essential templates.

Types of Budget Spreadsheet Templates

Budget spreadsheet templates come in various types to cater to different financial needs and preferences. Each type has its unique features and purposes, along with advantages and disadvantages. Let’s explore some common types below:

Monthly Budget Template

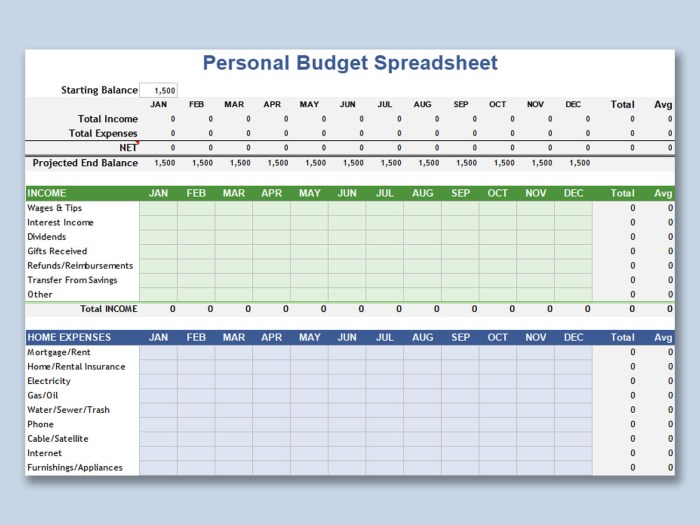

- Features: Tracks income, expenses, and savings on a monthly basis.

- Purpose: Helps individuals monitor their financial health and plan for the month ahead.

- Advantages: Provides a clear overview of monthly finances and aids in identifying areas for improvement.

- Disadvantages: May require frequent updates and adjustments based on changing financial circumstances.

Annual Budget Template

- Features: Projects income, expenses, and savings for an entire year.

- Purpose: Allows for long-term financial planning and goal setting.

- Advantages: Offers a comprehensive view of annual finances and helps in setting realistic financial targets.

- Disadvantages: Requires meticulous tracking and may need regular reviews to stay accurate.

Debt Payoff Template

- Features: Focuses on managing and paying off debts efficiently.

- Purpose: Helps individuals create a strategic plan to eliminate debt and achieve financial freedom.

- Advantages: Encourages disciplined repayment strategies and motivates debt reduction efforts.

- Disadvantages: Requires strict adherence to the plan and may limit discretionary spending until debts are cleared.

Customizing Budget Spreadsheet Templates

When it comes to budgeting, one size does not fit all. That’s why customizing budget spreadsheet templates is key to managing your finances effectively. By personalizing your template to fit your individual needs, you can track your income, expenses, and savings in a way that makes sense for you.

Steps to Customize a Budget Spreadsheet Template

- Start by identifying your financial goals and priorities. Whether you’re saving for a vacation, paying off debt, or building an emergency fund, knowing what you’re working towards will help you tailor your template accordingly.

- Modify categories to align with your spending habits. If the pre-set categories in the template don’t match your expenses, feel free to add, remove, or rename categories to accurately reflect where your money is going.

- Adjust formulas and calculations to suit your needs. Make sure that the formulas in the spreadsheet are set up correctly based on your income sources, expenses, and savings goals. This will ensure that you get an accurate picture of your financial situation.

- Personalize the design and layout of the template. Customizing the colors, fonts, and overall look of the spreadsheet can make it more visually appealing and easier to use on a day-to-day basis.

Importance of Customizing Templates to Fit Individual Needs

Customizing budget spreadsheet templates allows you to create a financial tool that works specifically for you. By tailoring the template to your unique situation, you can better track your progress towards your financial goals and make informed decisions about your money.

Tips on Personalizing Templates Effectively for Specific Financial Goals

- Regularly review and update your budget spreadsheet to ensure it reflects your current financial situation.

- Use color coding or different formatting to highlight priority areas or areas where you need to cut back on spending.

- Consider creating separate tabs or sections for different aspects of your finances, such as monthly expenses, savings goals, and debt repayment.

- Don’t be afraid to experiment with different layouts and formats until you find one that works best for you.

Best Practices for Using Budget Spreadsheet Templates

Using budget spreadsheet templates can be a powerful tool for managing finances effectively. Here are some best practices to make the most out of them:

Maintaining and Updating Budget Spreadsheet Templates

Regular maintenance and updates are crucial to ensure that your budget spreadsheet remains accurate and relevant. Here are some tips:

- Set aside dedicated time each month to review and update your budget spreadsheet.

- Check for any discrepancies or errors in your financial data and correct them promptly.

- Include categories for both fixed and variable expenses to capture all aspects of your spending.

- Make notes of any changes in income or expenses to adjust your budget accordingly.

Reviewing and Adjusting Budget Templates

It’s important to review and adjust your budget templates regularly to reflect changes in your financial situation. Here’s how often you should do it:

- Review your budget at least once a month to track your progress and make any necessary adjustments.

- Consider reviewing your budget more frequently during times of financial change or uncertainty.

- Adjust your budget as needed to accommodate new expenses, income fluctuations, or financial goals.

Financial Planning and Monitoring with Budget Templates

Budget templates are valuable tools for financial planning and monitoring. Here’s how they can help you:

- Set specific financial goals and track your progress towards achieving them using your budget spreadsheet.

- Monitor your spending habits and identify areas where you can cut costs or save more money.

- Use budget templates to forecast future expenses and income, helping you make informed financial decisions.

Features to Look for in Budget Spreadsheet Templates

When choosing a budget spreadsheet template, it’s crucial to look for features that can help you effectively manage your finances. From user-friendly interfaces to advanced functionalities, the right template can make a significant difference in your budgeting process.

User-Friendly Interfaces

A user-friendly interface is essential for a budget spreadsheet template as it allows for easy navigation and input of financial data. Look for templates that are intuitive to use, with clear labels and organized sections to help you track your income and expenses seamlessly.

Automated Calculations

One of the key features to look for in a budget spreadsheet template is automated calculations. This advanced functionality can save you time and reduce errors by automatically calculating totals, percentages, and other important financial metrics. Make sure the template you choose has built-in formulas for common budgeting calculations.

Data Visualization Options

Another important feature to consider is data visualization options. Visual representations of your budget data, such as charts or graphs, can help you easily identify spending patterns, trends, and areas for improvement. Look for templates that offer customizable visualization tools to suit your specific budgeting needs.