Diving into the world of financial stress management, this intro is here to grab your attention and keep you hooked. From understanding the impact to exploring effective strategies, get ready to conquer those money worries like a boss.

Get ready to explore practical tips, seek professional help, make lifestyle changes, and more as we break down the ins and outs of handling financial stress.

Understanding Financial Stress

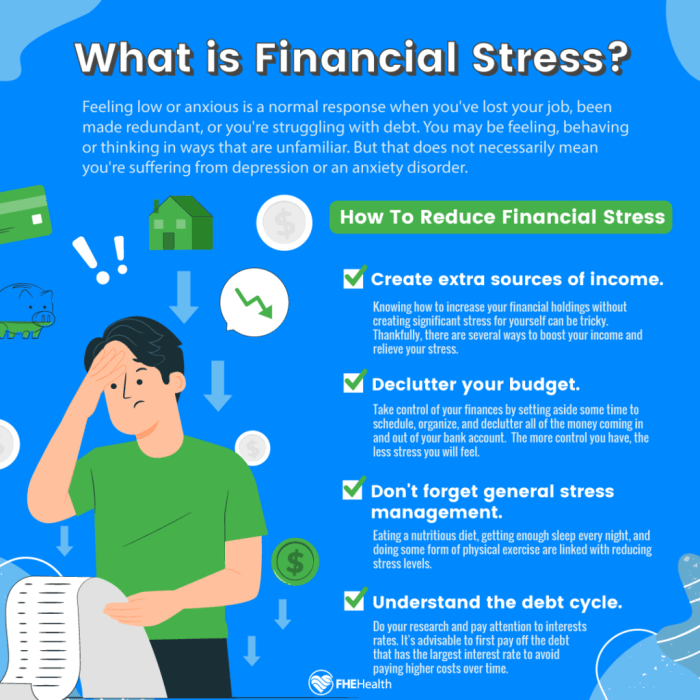

Financial stress is the overwhelming feeling of not being able to meet financial demands, leading to anxiety, worry, and negative effects on mental health. It can impact individuals of all ages and backgrounds, causing a significant strain on overall well-being.

Common Causes of Financial Stress

- High levels of debt, including credit card debt, student loans, or mortgages.

- Low income or unemployment, making it difficult to cover basic expenses.

- Unexpected expenses such as medical bills, car repairs, or home maintenance.

- Lack of savings or emergency fund to fall back on in times of need.

- Financial mismanagement, overspending, or living beyond one’s means.

Relationship between Financial Stress and Mental Health

Financial stress can significantly impact mental health, leading to increased levels of anxiety, depression, and overall feelings of helplessness. The constant worry about finances can disrupt sleep patterns, decrease productivity, and strain relationships. Seeking support and implementing healthy coping mechanisms are essential in managing financial stress and maintaining overall well-being.

Effective Strategies for Managing Financial Stress

Financial stress can be overwhelming, but there are practical tips that can help you navigate through challenging times and alleviate some of the pressure.

Importance of Budgeting and Financial Planning

- Create a detailed budget outlining your monthly income and expenses. This will help you track where your money is going and identify areas where you can cut back.

- Set financial goals and prioritize your spending to align with these goals. Having a clear plan in place can reduce uncertainty and anxiety about your financial future.

- Regularly review and adjust your budget as needed. Circumstances may change, so it’s important to be flexible and make necessary modifications to stay on track.

Role of Emergency Funds in Alleviating Financial Stress

- Build an emergency fund to cover unexpected expenses like medical bills or car repairs. Having this financial cushion can provide peace of mind and prevent you from going into debt when faced with emergencies.

- Save at least three to six months’ worth of living expenses in your emergency fund. This will ensure you have enough to cover essential costs in case of job loss or other financial setbacks.

- Keep your emergency fund in a separate savings account that is easily accessible but not tied to your everyday spending. This will help you resist the temptation to dip into it for non-emergencies.

Seeking Professional Help

When dealing with overwhelming financial stress, seeking help from financial advisors can be advisable. These professionals can offer personalized guidance and strategies to help you navigate your financial situation more effectively.

Benefits of Credit Counseling Services

- Credit counseling services provide expert advice on managing debt and improving credit scores.

- They can help you create a realistic budget and develop a debt repayment plan tailored to your financial situation.

- Through credit counseling, you can learn valuable financial management skills to avoid future financial pitfalls.

Impact of Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can have the following benefits:

- Reducing the overall interest rate and monthly payments, making it easier to manage debt.

- Simplifying your debt repayment process by consolidating multiple payments into one.

- Helping you pay off your debt faster and potentially improving your credit score over time.

Lifestyle Changes and Financial Stress

Managing financial stress often requires making lifestyle changes that can positively impact your mental and emotional well-being. These changes can help reduce anxiety and improve your overall quality of life. Here are some ways lifestyle changes can help in managing financial stress:

Engaging in Stress-Relief Activities

Engaging in stress-relief activities can be a cost-effective way to manage financial stress. These activities can help you relax, unwind, and take your mind off financial worries. Some examples of stress-relief activities include:

- Practicing mindfulness or meditation

- Going for a walk or engaging in physical exercise

- Spending time with loved ones and socializing

- Pursuing hobbies or creative outlets

- Listening to music or reading a book

Importance of Work-Life Balance

Maintaining a healthy work-life balance is crucial in reducing financial stress. When you prioritize self-care and allocate time for relaxation and activities outside of work, you can prevent burnout and improve your overall well-being. Finding a balance between work responsibilities and personal life can help you manage stress more effectively and enhance your mental resilience.