Get ready to dive into the world of payday loans, where quick cash meets financial decisions. Whether you’re curious or in need of some fast facts, this guide has got you covered.

Exploring the concept, process, pros, cons, and impact of payday loans will shed light on this often misunderstood financial tool.

What are payday loans?

Payday loans are short-term loans typically used by individuals who need quick access to cash before their next paycheck. These loans are meant to be a temporary solution for financial emergencies or unexpected expenses.

Purpose of Payday Loans

- Example 1: Covering urgent medical expenses

- Example 2: Car repairs to get to work

- Example 3: Paying bills to avoid late fees

Terms and Conditions

- Payday loans usually have high interest rates

- Short repayment period, often due on the borrower’s next payday

- Lenders may require access to the borrower’s bank account or post-dated check

How do payday loans work?

When it comes to payday loans, it’s important to understand how the process works from start to finish. From obtaining the loan to repaying it, there are specific steps and requirements involved.

Obtaining a Payday Loan

- First, you need to find a payday lender, either in-person or online.

- Next, you’ll need to provide proof of income, a valid ID, and a bank account.

- Once approved, you’ll receive the funds either in cash or deposited directly into your bank account.

Requirements and Eligibility Criteria

- Typically, you need to be at least 18 years old and have a steady source of income.

- Some lenders may require a minimum income threshold and a good credit score.

- It’s important to note that payday loans are usually meant for short-term financial needs.

Repayment Structure

- Payday loans are usually due on your next payday, hence the name.

- Interest rates on payday loans can be extremely high, sometimes reaching triple digits.

- Failure to repay the loan on time can result in additional fees and increased interest rates.

- Some borrowers may get caught in a cycle of debt if they continuously roll over their payday loans.

Pros and cons of payday loans.

When considering payday loans, it’s essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of payday loans

- Quick access to cash: Payday loans provide fast money when you need it urgently, typically within 24 hours.

- No credit check required: Even if you have a poor credit score, you can still qualify for a payday loan.

- Easy application process: Applying for a payday loan is simple and can often be done online or in-person at a local lender.

Disadvantages and risks of payday loans

- High fees and interest rates: Payday loans come with high fees and interest rates, making them an expensive form of borrowing.

- Debt cycle: Borrowers can get trapped in a cycle of debt if they continually roll over their payday loans, leading to financial instability.

- Aggressive collection practices: Some payday lenders use aggressive tactics to collect payment, causing stress and anxiety for borrowers.

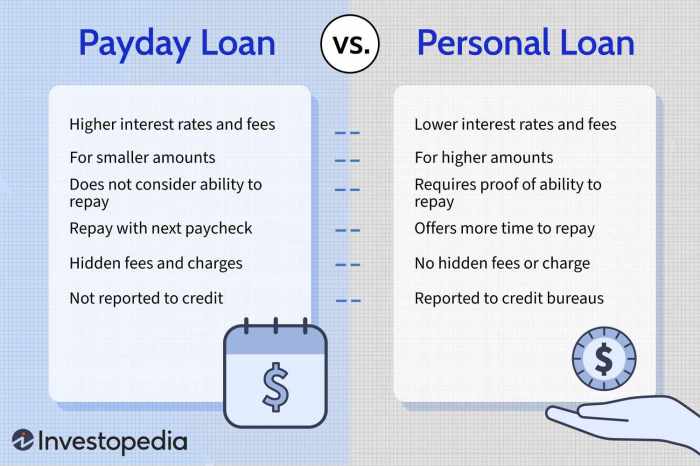

Comparison with other forms of borrowing

- Personal loans: Personal loans typically have lower interest rates and longer repayment terms compared to payday loans, making them a more affordable option.

- Credit cards: While credit cards also come with high-interest rates, they offer more flexibility in repayment and can be used for ongoing expenses rather than just emergencies.

Understanding the impact of payday loans.

When it comes to payday loans, the impact on an individual’s financial situation can be significant. Let’s take a closer look at the potential consequences and how they can affect overall financial health.

Cycle of debt with payday loans

- Payday loans often come with high-interest rates, making it difficult for borrowers to repay the full amount.

- Individuals may find themselves in a cycle of debt, where they continuously borrow to cover previous loans, leading to a never-ending cycle of repayment.

- This cycle can result in a significant drain on financial resources, making it challenging to break free from the debt trap.

Impact on credit scores and financial health

- Defaulting on payday loans can have a negative impact on credit scores, making it harder to access other forms of credit in the future.

- Repeated use of payday loans can signal financial instability to lenders, further damaging creditworthiness.

- Overall, payday loans can contribute to a downward spiral of financial health, affecting long-term financial stability.