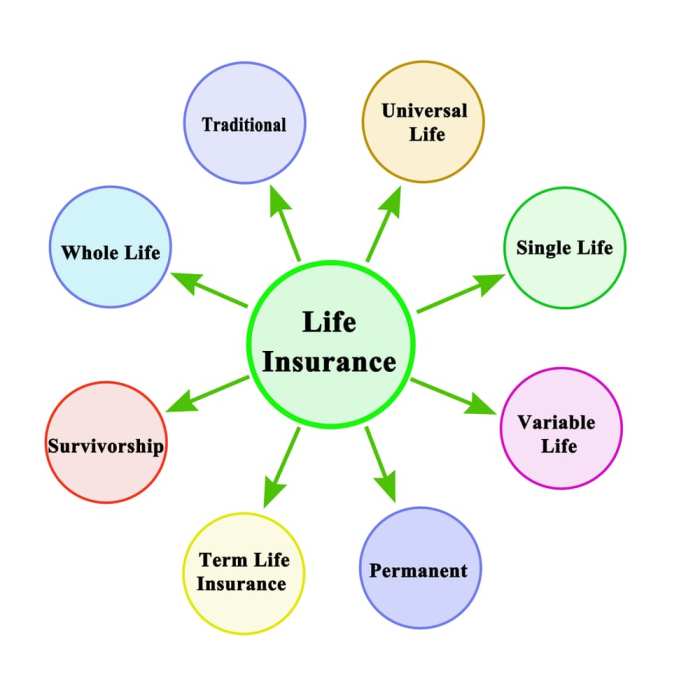

Diving into the realm of life insurance, we uncover a variety of options that cater to different needs and preferences. From term life to whole life, each type offers unique features and benefits that ensure financial security and peace of mind for the future. Let’s explore the nuances of each type and discover which one suits you best.

As we navigate through the intricacies of term life, whole life, universal life, and variable life insurance, you’ll gain insights into the diverse landscape of protection and investment opportunities available in the market.

Types of Life Insurance

Term life insurance is like renting a place; you pay for a specific period, and it covers you during that time. It’s simple and affordable, but once the term ends, you’re out without any coverage.

Whole Life Insurance

Whole life insurance is like owning a home; it provides coverage for your entire life as long as premiums are paid. It also builds cash value over time, which you can borrow against or withdraw.

Universal Life Insurance vs. Variable Life Insurance

Universal life insurance offers flexibility in premiums and death benefits, allowing you to adjust as needed. It also accumulates cash value at a fixed interest rate.

On the other hand, variable life insurance allows you to invest in sub-accounts like mutual funds, potentially earning higher returns. However, it also comes with more risk as the cash value fluctuates based on market performance.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If the insured passes away during the term, the beneficiaries receive the death benefit.

Term life insurance is most suitable for individuals who are looking for temporary coverage to protect their loved ones in case of an unexpected death. It is often chosen by young families, individuals with large debts, or those with dependents who rely on their income.

Level Term vs Decreasing Term Life Insurance

Level term life insurance offers a fixed death benefit throughout the policy term. Premiums remain the same, making it easier to budget for the coverage. This type is ideal for those who want consistent coverage for a specific duration.

On the other hand, decreasing term life insurance provides a death benefit that decreases over time. This type of policy is often used to cover a specific debt that decreases, such as a mortgage. Premiums are generally lower compared to level term policies.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid. It offers both a death benefit and a cash value component that grows over time.

Cash Value Component

The cash value component of whole life insurance is a savings account that is built into the policy. A portion of the premiums paid by the policyholder goes towards this cash value, which earns interest over time on a tax-deferred basis. Policyholders can borrow against this cash value or even surrender the policy for its cash value.

Guaranteed Death Benefit

One of the key features of whole life insurance policies is the guaranteed death benefit. This means that the insurance company guarantees to pay out a specified amount to the beneficiaries upon the death of the insured, as long as premiums are paid. The death benefit is not dependent on the cash value of the policy.

Dividends

Some whole life insurance policies pay out dividends to policyholders. These dividends are a portion of the insurance company’s profits and are not guaranteed. Policyholders can choose to receive the dividends in cash, use them to reduce premiums, accumulate them with interest, or purchase additional paid-up insurance.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and an investment component. Unlike term life insurance, universal life insurance provides coverage for your entire life as long as premiums are paid.

Flexibility of Premium Payments

Universal life insurance allows policyholders to adjust their premium payments within certain limits. This means you can increase or decrease your premium amount or even take a break from paying premiums altogether, depending on your financial situation. However, it’s important to note that reducing or stopping premium payments can affect the cash value and death benefit of the policy.

Investment Component

One of the key features of universal life insurance is the ability to build cash value over time. A portion of your premium payments goes towards a cash account, which earns interest at a rate set by the insurance company. This cash value can be used to cover premiums, take out loans, or even make withdrawals, although these may impact the death benefit if not repaid.

Fixed vs. Indexed Universal Life Insurance

Fixed universal life insurance offers a guaranteed interest rate on the cash value, providing stability but potentially limiting growth. On the other hand, indexed universal life insurance ties the cash value growth to a market index, offering the potential for higher returns but also the risk of lower interest rates in certain market conditions. Policyholders can choose the type of universal life insurance that best fits their risk tolerance and financial goals.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows policyholders to allocate a portion of their premiums into various investment options such as stocks, bonds, and mutual funds. The cash value of a variable life insurance policy can fluctuate based on the performance of these investments.

Investment Management

In variable life insurance, the investments are managed by the policyholder who can choose how to allocate their premiums among the available investment options. This gives policyholders the potential for higher returns compared to other types of life insurance but also exposes them to market risks.

- Policyholders can switch between investment options based on their risk tolerance and investment goals.

- The performance of the investments directly impacts the cash value and death benefit of the policy.

Risks

Variable life insurance policies come with inherent risks due to the volatility of the financial markets. The cash value of the policy can decrease if the investments underperform, leading to a potential loss of savings and reduced death benefit.

- Market fluctuations can impact the overall value of the policy.

- Policyholders bear the investment risks and are responsible for making informed decisions about their investment allocations.

Cash Value Growth

One of the key attractions of variable life insurance is the potential for cash value growth over time. If the investments perform well, the cash value of the policy can increase, providing policyholders with additional funds that can be used for various purposes.

- Policyholders can access the cash value through withdrawals or policy loans.

- The cash value growth is tax-deferred, allowing for potential tax advantages.