Credit union benefits set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we dive into the realm of credit unions, get ready to discover a world where better interest rates, lower fees, and superior customer service await.

Benefits of Joining a Credit Union

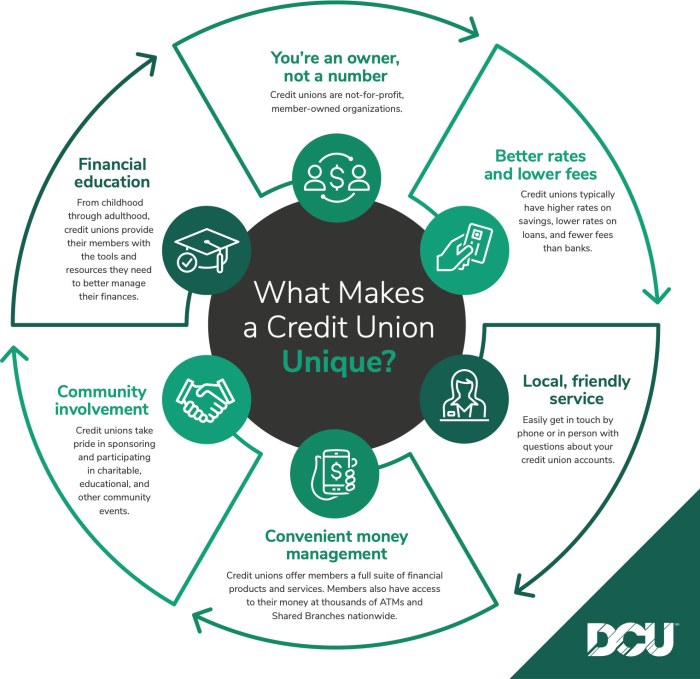

Joining a credit union comes with a plethora of benefits that can greatly improve your financial well-being. From better interest rates to exceptional customer service, credit unions offer a unique banking experience that prioritizes their members.

Better Interest Rates

Credit unions typically provide higher interest rates on savings accounts and lower interest rates on loans compared to traditional banks. This means you can earn more on your deposits and pay less on your borrowed funds, ultimately saving you money in the long run.

Lower Fees and Better Customer Service

Credit unions are known for their minimal fees and charges, making it more cost-effective to manage your finances. Additionally, credit unions prioritize personalized customer service, ensuring that members receive individualized attention and assistance with their financial needs.

Credit Union Membership Eligibility

Joining a credit union isn’t as complicated as solving a math problem, but there are some eligibility criteria you need to meet before you can be a part of the cool credit union crew.

Comparison with Banks

In comparison to banks, credit unions have more relaxed membership requirements. While banks focus on profit, credit unions are all about serving their members and communities.

- Membership in a specific organization or community

- Employment at a certain company or industry

- Family relationship to an existing member

Common Eligibility Criteria

Be prepared to show some ID and proof of eligibility, like a pay stub or membership card.

- Living in a specific geographic area

- Belonging to a certain profession or industry

- Being a member of a specific organization or association

Services Offered by Credit Unions

Credit unions offer a variety of financial services to their members, similar to traditional banks but with some key differences. These services are designed to help members manage their finances, save money, and achieve their financial goals.

Checking and Savings Accounts

- Credit unions typically offer checking and savings accounts with competitive interest rates and low fees compared to traditional banks.

- Members can access their accounts online, through mobile banking apps, and at ATMs for added convenience.

- Some credit unions may also offer rewards programs for debit card purchases or savings incentives.

Loans and Credit Cards

- Credit unions provide various loan options, including personal loans, auto loans, and mortgages, often with lower interest rates and more flexible terms than banks.

- Members can also apply for credit cards through their credit union, with benefits like cashback rewards or lower APRs.

- Credit unions are known for their personalized service and willingness to work with members to find the best borrowing solutions.

Financial Planning and Investment Services

- Many credit unions offer financial planning services, retirement planning, and investment advice to help members secure their financial future.

- Members can meet with financial advisors at the credit union to discuss their goals and create a customized plan.

- Some credit unions may also provide access to investment products like mutual funds or IRAs.

Insurance and Member Benefits

- Credit unions often partner with insurance providers to offer competitive rates on auto, home, and life insurance policies.

- Members may also be eligible for discounts on services like car rentals, travel accommodations, and more through the credit union’s partnerships.

- Some credit unions provide additional member benefits such as identity theft protection or roadside assistance programs.

Credit Union Community Involvement

Credit unions are deeply committed to their local communities, often going above and beyond to make a positive impact. Their involvement ranges from sponsoring local events to supporting charitable causes and promoting financial literacy.

Community Initiatives and Programs

- Financial Education Workshops: Credit unions frequently organize workshops and seminars to educate community members on topics such as budgeting, saving, and credit management.

- Scholarship Programs: Many credit unions offer scholarships to local students to help them pursue higher education and achieve their academic goals.

- Community Clean-up Campaigns: Some credit unions organize clean-up campaigns in collaboration with local organizations to improve the environment and enhance the quality of life in the community.

- Food Drives: Credit unions often host food drives to support local food banks and help alleviate hunger in their communities.

Impact on Members and Society

Credit unions’ community involvement has a significant impact on both their members and society as a whole. By providing financial education and support, credit unions empower individuals to make informed decisions and improve their financial well-being. This, in turn, leads to a more financially literate and resilient community. Additionally, initiatives such as scholarship programs and community clean-up campaigns contribute to the overall development and cohesion of the society, fostering a sense of unity and mutual support among community members.