Kicking off with Dividend investing strategies, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

Diving into the world of dividend investing, where savvy investors reap the rewards of strategic financial maneuvers.

Introduction to Dividend Investing

Dividend investing is a strategy where investors focus on purchasing stocks that pay out regular dividends. These dividends are a portion of the company’s profits distributed to shareholders as a reward for holding onto their stock.

Benefits of Dividend Investing

- Stable Income: Dividend-paying stocks provide a steady stream of income, making them attractive for investors looking for consistent cash flow.

- Long-Term Growth: Companies that pay dividends tend to be more stable and profitable, leading to potential long-term growth in both stock price and dividend payouts.

- Dividend Reinvestment: Investors can reinvest their dividends to purchase more shares, leading to compound growth over time.

Examples of Companies Known for Their Dividend Payouts

Some well-known companies that are recognized for their consistent dividend payouts include:

- Apple Inc. (AAPL): Apple has a history of increasing its dividend payouts and is a favorite among dividend investors.

- Johnson & Johnson (JNJ): Known for its stability and consistent dividend growth, J&J is a popular choice for dividend-focused portfolios.

- AT&T Inc. (T): AT&T is a telecommunications giant that has a long history of paying out dividends, making it an attractive option for income investors.

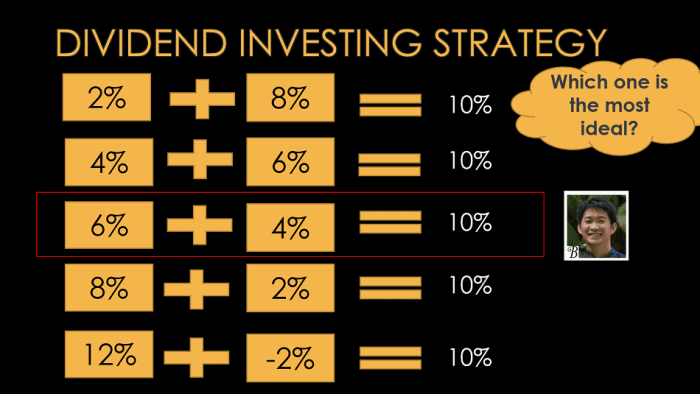

Types of Dividend Investing Strategies

When it comes to dividend investing, there are several key strategies that investors can consider. Each strategy has its own unique approach and potential benefits. Let’s take a closer look at some of the most common types of dividend investing strategies and how they differ from each other.

Dividend Growth Investing

Dividend growth investing focuses on investing in companies that have a track record of consistently increasing their dividends over time. These companies are typically well-established and have a strong financial performance. Investors who follow this strategy are looking for companies with the potential to continue growing their dividends in the future. Examples of companies suitable for dividend growth investing include Johnson & Johnson, Coca-Cola, and Procter & Gamble.

High Yield Dividend Investing

High yield dividend investing involves investing in companies that offer high dividend yields relative to their stock price. These companies may not necessarily have a history of consistent dividend growth, but they offer attractive dividend payouts. Investors following this strategy are often looking for immediate income from their investments. Examples of companies suitable for high yield dividend investing include AT&T, Exxon Mobil, and Verizon.

Value Dividend Investing

Value dividend investing combines traditional value investing principles with a focus on dividends. Investors following this strategy look for undervalued companies that also offer attractive dividend yields. These companies may not always be popular or high-growth, but they are considered to be trading at a discount relative to their intrinsic value. Examples of companies suitable for value dividend investing include Chevron, IBM, and General Electric.

Factors to Consider in Dividend Investing

When diving into the world of dividend investing, there are several key factors that investors should carefully consider to make informed decisions and maximize their returns.

Economic Conditions Impact

The economic environment plays a crucial role in dividend investing. During economic downturns, companies may struggle to maintain or increase their dividend payouts. On the other hand, in times of economic prosperity, companies may have more cash flow to distribute as dividends. Understanding the current economic conditions and how they can affect a company’s ability to pay dividends is essential for successful dividend investing.

Company’s Dividend History Analysis

Analyzing a company’s dividend history is vital in assessing its reliability as a dividend-paying stock. Consistent and growing dividend payments over time indicate a financially stable and well-managed company. On the contrary, a fluctuating or decreasing dividend history may raise red flags about the company’s financial health. By delving into a company’s dividend track record, investors can gain valuable insights into its performance and future dividend potential.

Best Practices for Dividend Investing

When it comes to dividend investing, there are some key best practices that can help beginners navigate the world of investing in dividend-paying stocks. From tips for starting out to strategies for reinvesting dividends, these practices can help you build a strong and diversified portfolio.

Tips for Beginners Starting with Dividend Investing

For beginners looking to start with dividend investing, it’s important to do your research and understand the basics of how dividends work. Consider starting with well-established companies that have a history of paying consistent dividends. Additionally, focus on companies with a strong track record of financial stability and growth.

Creating a Diversified Dividend Portfolio

Creating a diversified dividend portfolio involves spreading your investments across different sectors and industries to reduce risk. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to diversify your portfolio. Additionally, consider adding dividend ETFs or mutual funds to further diversify your holdings.

Strategies for Reinvesting Dividends Effectively

Reinvesting dividends can help accelerate the growth of your investment portfolio over time. One effective strategy is to enroll in a dividend reinvestment plan (DRIP) offered by many companies, allowing you to automatically reinvest your dividends to purchase additional shares. Another strategy is to manually reinvest dividends in undervalued stocks or sectors to take advantage of buying opportunities.

Risks and Challenges in Dividend Investing

When it comes to dividend investing, there are certain risks and challenges that investors need to be aware of in order to make informed decisions and protect their investments. Market volatility, in particular, can have a significant impact on dividend stocks and it is crucial to understand how to manage these risks effectively.

Market Volatility and Dividend Stocks

Market volatility refers to the rapid and unpredictable price fluctuations in the stock market. This can have a direct impact on dividend stocks as their prices can be affected by external factors such as economic conditions, geopolitical events, and investor sentiment. During periods of high volatility, dividend stocks may experience sharp declines in value, leading to potential losses for investors.

To manage the risks associated with market volatility, investors can consider diversifying their dividend portfolio across different sectors and industries. By spreading out investments, investors can reduce the impact of volatility on their overall portfolio. Additionally, focusing on companies with a history of stable dividend payments and strong fundamentals can help mitigate the risks of market fluctuations.

Overall, understanding how market volatility can affect dividend stocks and implementing strategies to manage these risks are essential for successful dividend investing.