Kicking off with Asset allocation strategies, this opening paragraph is designed to captivate and engage the readers, setting the tone for what’s to come. Asset allocation is the key to a successful investment plan, determining how your portfolio is spread across different types of assets. Let’s dive into this essential concept and explore the strategies that can help you achieve your financial goals.

Asset Allocation Strategies

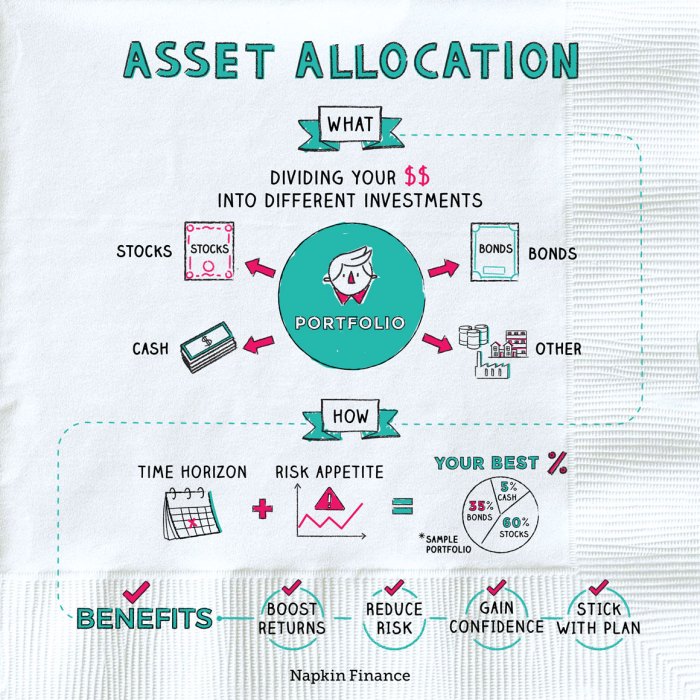

Asset allocation is the practice of spreading your investments across different asset classes to reduce risk and optimize returns. By diversifying your portfolio, you can potentially minimize losses during market downturns and take advantage of growth opportunities in various sectors.

Types of Assets in a Portfolio

When building a portfolio, you can include a variety of assets such as:

- Stocks

- Bonds

- Real Estate

- Commodities

- Cash Equivalents

Importance of Asset Allocation

Asset allocation is crucial in investment planning as it helps manage risk and maximize returns. By spreading your investments across different asset classes, you can reduce the impact of market volatility on your portfolio. This strategy also allows you to take advantage of growth opportunities in various sectors while safeguarding against potential losses.

Benefits of Diversification through Asset Allocation

Diversification through asset allocation offers several benefits, including:

- Reduced Risk: Spreading investments across multiple asset classes lowers the risk of significant losses in any one sector.

- Optimized Returns: By investing in a mix of assets, you can potentially achieve a balance between risk and return that aligns with your financial goals.

- Stability: Diversification can help stabilize your portfolio’s performance over time, even in fluctuating market conditions.

Types of Asset Allocation

When it comes to asset allocation, there are various strategies that investors can implement based on their risk tolerance, investment goals, and time horizon. Let’s dive into the different types of asset allocation strategies below.

Conservative Asset Allocation

Conservative asset allocation strategies focus on preserving capital and generating a steady income stream. Investors who opt for this approach typically allocate a higher percentage of their portfolio to fixed-income securities such as bonds and cash equivalents. The goal is to minimize volatility and protect against market downturns. While conservative asset allocation may offer lower returns compared to more aggressive strategies, it provides stability and security, making it suitable for risk-averse investors nearing retirement or those with a shorter investment horizon.

Aggressive Asset Allocation

On the other end of the spectrum, aggressive asset allocation strategies aim to maximize returns by investing a larger portion of the portfolio in equities or high-risk assets. This approach is suited for investors with a longer time horizon who are willing to tolerate higher levels of risk in exchange for potentially higher rewards. Aggressive asset allocation may involve investing in growth stocks, emerging markets, or alternative investments with the goal of achieving significant capital appreciation over time.

Strategic vs. Tactical Asset Allocation

Strategic asset allocation involves setting a long-term target allocation based on the investor’s risk tolerance and financial goals. This allocation is rebalanced periodically to maintain the desired asset mix. In contrast, tactical asset allocation involves making short-term adjustments to the portfolio based on market conditions or economic outlook. While strategic asset allocation is more passive in nature, tactical asset allocation allows for more flexibility and responsiveness to changing market dynamics.

Dynamic Asset Allocation

Dynamic asset allocation combines elements of both strategic and tactical approaches by incorporating a rules-based methodology to adjust the asset mix dynamically in response to changing market conditions. This approach aims to capitalize on short-term opportunities while maintaining a long-term investment strategy. Dynamic asset allocation can help investors navigate volatile market environments and optimize portfolio performance over time.

Factors Influencing Asset Allocation

When it comes to making decisions about asset allocation, there are several key factors that come into play. These factors can greatly impact the overall strategy and success of your investment portfolio. Let’s take a closer look at some of the main influencers.

Risk Tolerance

Risk tolerance plays a crucial role in determining asset allocation strategies. It refers to your ability and willingness to endure fluctuations in the value of your investments. Investors with a higher risk tolerance may opt for a more aggressive allocation with a higher percentage of stocks, while those with a lower risk tolerance may choose a more conservative approach with a larger allocation to bonds or cash.

Investment Goals

Your investment goals also play a significant role in asset allocation decisions. Whether you are saving for retirement, a major purchase, or simply looking to grow your wealth, your goals will dictate the level of risk you are willing to take on and the types of assets you should invest in. It’s important to align your asset allocation with your specific goals to ensure you are on track to achieve them.

Time Horizon Considerations

The time horizon of your investments is another crucial factor in determining asset allocation. If you have a longer time horizon, you may be able to take on more risk and invest in assets with higher potential returns, such as stocks. On the other hand, if you have a shorter time horizon, you may want to focus on more stable investments with lower volatility, such as bonds or cash equivalents.

Implementing Asset Allocation

When it comes to implementing asset allocation, it’s essential to have a well-thought-out plan in place. This involves creating a strategy that aligns with your financial goals and risk tolerance. Let’s dive into the step-by-step guide on how to create an asset allocation plan.

Creating an Asset Allocation Plan

- Determine your financial goals and risk tolerance.

- Identify different asset classes such as stocks, bonds, and real estate.

- Allocate a percentage of your portfolio to each asset class based on your goals and risk tolerance.

- Regularly review and adjust your asset allocation as needed.

Importance of Rebalancing

Rebalancing is crucial in maintaining your asset allocation over time. It involves periodically adjusting your portfolio back to your target allocation to ensure that you stay on track with your investment objectives.

Rebalancing helps to control risk and prevent your portfolio from becoming too heavily weighted in one asset class.

Considering Tax Implications

- Understand the tax implications of different asset classes.

- Utilize tax-efficient investment strategies to minimize the impact on your overall returns.

- Consider utilizing tax-advantaged accounts like IRAs and 401(k)s for certain investments.

Monitoring and Adjusting Asset Allocation

It’s important to regularly monitor your asset allocation and make adjustments as needed. Life circumstances, market conditions, and financial goals may change, requiring you to realign your investments accordingly.

Stay informed about economic trends and market developments that may impact your asset allocation decisions.